The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Houghton Mifflin Harcourt Co (NASDAQ:HMHC).

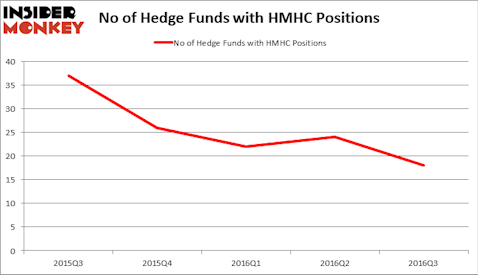

Houghton Mifflin Harcourt Co (NASDAQ:HMHC) was in 18 hedge funds’ portfolios at the end of the third quarter of 2016. HMHC investors should be aware of a decrease in hedge fund sentiment recently. There were 24 hedge funds in our database with HMHC positions at the end of the previous quarter. At the end of this article we will also compare HMHC to other stocks including Xenia Hotels & Resorts Inc (NYSE:XHR), Stamps.com Inc. (NASDAQ:STMP), and Descartes Systems Group (USA) (NASDAQ:DSGX) to get a better sense of its popularity.

Follow Houghton Mifflin Harcourt Co (NASDAQ:HMHC)

Follow Houghton Mifflin Harcourt Co (NASDAQ:HMHC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Evgeny Vorobiev/Shutterstock.com

How are hedge funds trading Houghton Mifflin Harcourt Co (NASDAQ:HMHC)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, down by 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HMHC over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Anchorage Advisors, led by Kevin Michael Ulrich and Anthony Davis, holds the most valuable position in Houghton Mifflin Harcourt Co (NASDAQ:HMHC). Anchorage Advisors has a $269.4 million position in the stock, comprising 27.6% of its 13F portfolio. On Anchorage Advisors’ heels is Glenn J. Krevlin of Glenhill Advisors, with a $125 million position; the fund has 7.5% of its 13F portfolio invested in the stock. Other peers that hold long positions include Gilchrist Berg’s Water Street Capital, Marc Lasry’s Avenue Capital and Jonathan Savitz’s Greywolf Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Houghton Mifflin Harcourt Co (NASDAQ:HMHC) has weathered a decline in interest from hedge fund managers, it’s safe to say that there exists a select few hedgies that elected to cut their positions entirely by the end of the third quarter. At the top of the heap, Michael M. Rothenberg’s Moab Capital Partners dropped the largest stake of all the investors watched by Insider Monkey, valued at an estimated $5.7 million in stock. Anand Parekh’s fund, Alyeska Investment Group, also sold off its stock, about $4.3 million worth.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Houghton Mifflin Harcourt Co (NASDAQ:HMHC) but similarly valued. These stocks are Xenia Hotels & Resorts Inc (NYSE:XHR), Stamps.com Inc. (NASDAQ:STMP), Descartes Systems Group (USA) (NASDAQ:DSGX), and Corrections Corp Of America (NYSE:CXW). This group of stocks’ market caps match HMHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XHR | 16 | 77504 | 5 |

| STMP | 31 | 415305 | 4 |

| DSGX | 4 | 25628 | 0 |

| CXW | 27 | 186592 | 12 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $176 million. That figure was $646 million in HMHC’s case. Stamps.com Inc. (NASDAQ:STMP) is the most popular stock in this table. On the other hand Descartes Systems Group (USA) (NASDAQ:DSGX) is the least popular one with only 4 bullish hedge fund positions. Houghton Mifflin Harcourt Co (NASDAQ:HMHC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard STMP might be a better candidate to consider taking a long position in.

Disclosure: None