The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards DuPont Fabros Technology, Inc. (NYSE:DFT) .

Is DuPont Fabros Technology, Inc. (NYSE:DFT) a first-rate investment now? Money managers are definitely reducing their bets on the stock. The number of bullish hedge fund bets that are revealed through the 13F filings slashed by1 recently. There were 19 hedge funds in our database with DFT positions at the end of the previous quarter. At the end of this article we will also compare DFT to other stocks including Bank of Hawaii Corporation (NYSE:BOH), Avis Budget Group Inc. (NASDAQ:CAR), and Integrated Device Technology, Inc. (NASDAQ:IDTI) to get a better sense of its popularity.

Follow Dupont Fabros Technology Inc. (NYSE:DFT)

Follow Dupont Fabros Technology Inc. (NYSE:DFT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Pressmaster/Shutterstock.com

Keeping this in mind, let’s view the recent action encompassing DuPont Fabros Technology, Inc. (NYSE:DFT).

What have hedge funds been doing with DuPont Fabros Technology, Inc. (NYSE:DFT)?

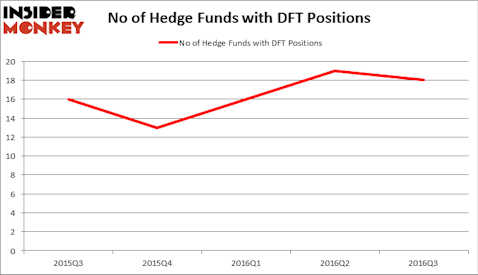

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decrease of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DFT over the last 5 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jeffrey Furber’s AEW Capital Management has the largest position in DuPont Fabros Technology, Inc. (NYSE:DFT), worth close to $109 million, amounting to 2.3% of its total 13F portfolio. The second largest stake is held by Ken Fisher of Fisher Asset Management, with a $54.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Jim Simons’s Renaissance Technologies, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that said goodbye to their entire stakes in the stock during the third quarter. Interestingly, Ken Heebner’s Capital Growth Management said goodbye to the largest stake of all the investors monitored by Insider Monkey, worth an estimated $49.9 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $2.8 million worth of DuPont Fabros Technology, Inc. (NYSE:DFT) shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as DuPont Fabros Technology, Inc. (NYSE:DFT) but similarly valued. These stocks are Bank of Hawaii Corporation (NYSE:BOH), Avis Budget Group Inc. (NASDAQ:CAR), Integrated Device Technology, Inc. (NASDAQ:IDTI), and NRG Yield, Inc. Class C (NYSE:NYLD). This group of stocks’ market values are similar to DFT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BOH | 10 | 49640 | 2 |

| CAR | 30 | 1080116 | -3 |

| IDTI | 25 | 311391 | -1 |

| NYLD | 25 | 209760 | -4 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $413 million. That figure was $269 million in DFT’s case. Avis Budget Group Inc. (NASDAQ:CAR) is the most popular stock in this table. On the other hand Bank of Hawaii Corporation (NYSE:BOH) is the least popular one with only 10 bullish hedge fund positions. DuPont Fabros Technology, Inc. (NYSE:DFT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CAR might be a better candidate to consider taking a long position in.

Disclosure: none.