The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 867 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article we look at what those investors think of Dollar Tree, Inc. (NASDAQ:DLTR).

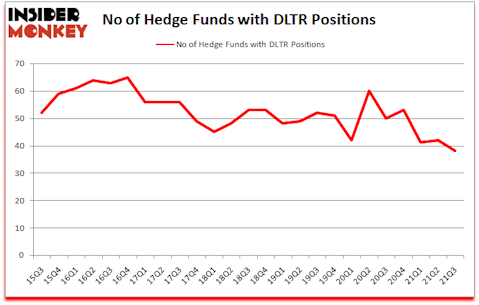

Dollar Tree, Inc. (NASDAQ:DLTR) shareholders have witnessed a decrease in enthusiasm from smart money of late. Dollar Tree, Inc. (NASDAQ:DLTR) was in 38 hedge funds’ portfolios at the end of September. The all time high for this statistic is 65. There were 42 hedge funds in our database with DLTR positions at the end of the second quarter. Our calculations also showed that DLTR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to take a look at the new hedge fund action encompassing Dollar Tree, Inc. (NASDAQ:DLTR).

Ian Wace of Marshall Wace

Do Hedge Funds Think DLTR Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DLTR over the last 25 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Akre Capital Management, managed by Charles Akre, holds the biggest position in Dollar Tree, Inc. (NASDAQ:DLTR). Akre Capital Management has a $342.8 million position in the stock, comprising 2.1% of its 13F portfolio. Coming in second is Rivulet Capital, led by Barry Lebovits and Joshua Kuntz, holding a $199.6 million position; 10.4% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Barry Dargan’s Intermede Investment Partners. In terms of the portfolio weights assigned to each position Rivulet Capital allocated the biggest weight to Dollar Tree, Inc. (NASDAQ:DLTR), around 10.41% of its 13F portfolio. KG Funds Management is also relatively very bullish on the stock, designating 8.22 percent of its 13F equity portfolio to DLTR.

Because Dollar Tree, Inc. (NASDAQ:DLTR) has faced falling interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of fund managers who sold off their entire stakes last quarter. Interestingly, Glenn Greenberg’s Brave Warrior Capital sold off the biggest investment of the 750 funds watched by Insider Monkey, worth an estimated $94.5 million in stock, and Steven Richman’s East Side Capital (RR Partners) was right behind this move, as the fund sold off about $84.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Dollar Tree, Inc. (NASDAQ:DLTR). We will take a look at TransUnion (NYSE:TRU), Mid America Apartment Communities Inc (NYSE:MAA), PPL Corporation (NYSE:PPL), Sun Communities Inc (NYSE:SUI), Martin Marietta Materials, Inc. (NYSE:MLM), Fox Corporation (NASDAQ:FOX), and Edison International (NYSE:EIX). All of these stocks’ market caps match DLTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRU | 38 | 2180644 | 3 |

| MAA | 22 | 254912 | 8 |

| PPL | 20 | 140767 | -3 |

| SUI | 33 | 794559 | 3 |

| MLM | 42 | 2154281 | 8 |

| FOX | 25 | 665945 | 0 |

| EIX | 25 | 1240177 | 7 |

| Average | 29.3 | 1061612 | 3.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.3 hedge funds with bullish positions and the average amount invested in these stocks was $1062 million. That figure was $1215 million in DLTR’s case. Martin Marietta Materials, Inc. (NYSE:MLM) is the most popular stock in this table. On the other hand PPL Corporation (NYSE:PPL) is the least popular one with only 20 bullish hedge fund positions. Dollar Tree, Inc. (NASDAQ:DLTR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DLTR is 59.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Hedge funds were also right about betting on DLTR as the stock returned 39.8% since the end of Q3 (through 11/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Automation Stocks For 2021

- 15 Billionaires Who Came From Nothing

- 10 Biggest Bitcoin Predictions in 2021

Disclosure: None. This article was originally published at Insider Monkey.