Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Cogent Biosciences, Inc. (NASDAQ:COGT)? The smart money sentiment can provide an answer to this question.

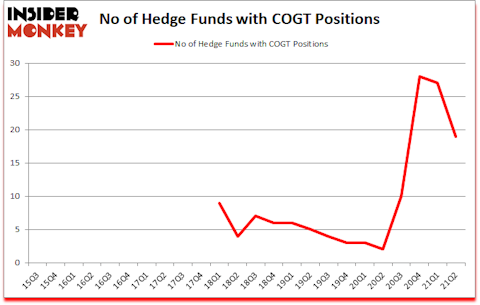

Cogent Biosciences, Inc. (NASDAQ:COGT) investors should be aware of a decrease in enthusiasm from smart money of late. Cogent Biosciences, Inc. (NASDAQ:COGT) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 28. There were 27 hedge funds in our database with COGT holdings at the end of March. Our calculations also showed that COGT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

James E. Flynn of Deerfield Management

Now let’s view the recent hedge fund action encompassing Cogent Biosciences, Inc. (NASDAQ:COGT).

Do Hedge Funds Think COGT Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -30% from the previous quarter. By comparison, 2 hedge funds held shares or bullish call options in COGT a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Perceptive Advisors, managed by Joseph Edelman, holds the biggest position in Cogent Biosciences, Inc. (NASDAQ:COGT). Perceptive Advisors has a $25.9 million position in the stock, comprising 0.3% of its 13F portfolio. Coming in second is Deerfield Management, managed by James E. Flynn, which holds a $13 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining peers that hold long positions include Ken Greenberg and David Kim’s Ghost Tree Capital, Mark Lampert’s Biotechnology Value Fund / BVF Inc and Steve Cohen’s Point72 Asset Management. In terms of the portfolio weights assigned to each position Commodore Capital allocated the biggest weight to Cogent Biosciences, Inc. (NASDAQ:COGT), around 3.82% of its 13F portfolio. Ghost Tree Capital is also relatively very bullish on the stock, earmarking 3.57 percent of its 13F equity portfolio to COGT.

Judging by the fact that Cogent Biosciences, Inc. (NASDAQ:COGT) has experienced a decline in interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their full holdings by the end of the second quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group said goodbye to the biggest investment of the 750 funds tracked by Insider Monkey, comprising about $11.1 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund cut about $6.7 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 8 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cogent Biosciences, Inc. (NASDAQ:COGT) but similarly valued. We will take a look at Limoneira Company (NASDAQ:LMNR), Utah Medical Products, Inc. (NASDAQ:UTMD), Verrica Pharmaceuticals Inc. (NASDAQ:VRCA), Carrols Restaurant Group, Inc. (NASDAQ:TAST), Huize Holding Limited (NASDAQ:HUIZ), StoneMor Inc. (NYSE:STON), and Hamilton Beach Brands Holding Company (NYSE:HBB). All of these stocks’ market caps match COGT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMNR | 4 | 2377 | 2 |

| UTMD | 4 | 26318 | 0 |

| VRCA | 6 | 61684 | -1 |

| TAST | 16 | 17178 | 3 |

| HUIZ | 2 | 1320 | 0 |

| STON | 2 | 232301 | -4 |

| HBB | 9 | 12495 | 1 |

| Average | 6.1 | 50525 | 0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.1 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $142 million in COGT’s case. Carrols Restaurant Group, Inc. (NASDAQ:TAST) is the most popular stock in this table. On the other hand Huize Holding Limited (NASDAQ:HUIZ) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Cogent Biosciences, Inc. (NASDAQ:COGT) is more popular among hedge funds. Our overall hedge fund sentiment score for COGT is 67.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Unfortunately COGT wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on COGT were disappointed as the stock returned 1% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Cogent Biosciences Inc. (NASDAQ:COGT)

Follow Cogent Biosciences Inc. (NASDAQ:COGT)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.