Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Agrium Inc. (USA) (NYSE:AGU) .

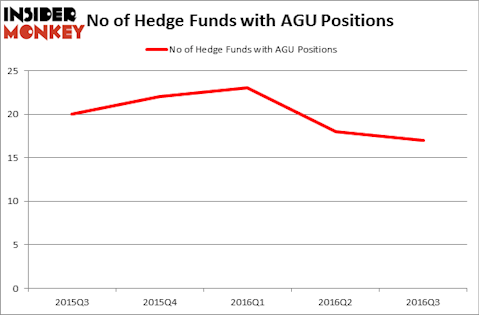

Is Agrium Inc. (USA) (NYSE:AGU) a buy, sell, or hold? Hedge funds are actually taking a pessimistic view. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings retreated by 1 in recent months. AGU was in 17 hedge funds’ portfolios at the end of the third quarter of 2016. There were 18 hedge funds in our database with AGU positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Citrix Systems, Inc. (NASDAQ:CTXS), Grupo Financero Sntdr Mxco SAB de CV ADR (NYSE:BSMX), and Cincinnati Financial Corporation (NASDAQ:CINF) to gather more data points.

Follow Agrium Inc (NYSE:AGU)

Follow Agrium Inc (NYSE:AGU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sean Pavone/Shutterstock.com

Hedge fund activity in Agrium Inc. (USA) (NYSE:AGU)

At the end of third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 6% from the second quarter of 2016, as hedge fund ownership falls further. The graph below displays the number of hedge funds with bullish positions in AGU over the last 5 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in Agrium Inc. (USA) (NYSE:AGU), worth close to $80.7 million. The second most bullish fund manager is Daniel Bubis of Tetrem Capital Management, with a $62.2 million position; the fund has 2.3% of its 13F portfolio invested in the stock. Other peers that are bullish encompass Howard Guberman’s Gruss Asset Management, Sander Gerber’s Hudson Bay Capital Management, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that Hudson Bay Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that said goodbye to their entire stakes in the stock during the third quarter. It’s worth mentioning that Joel Greenblatt’s Gotham Asset Management said goodbye to the biggest position of the 700 funds followed by Insider Monkey, worth about $22.6 million in stock, and Stephen J. Errico’s Locust Wood Capital Advisers was right behind this move, as the fund dropped about $9.7 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Agrium Inc. (USA) (NYSE:AGU). These stocks are Citrix Systems, Inc. (NASDAQ:CTXS), Grupo Financero Sntdr Mxco SAB de CV ADR (NYSE:BSMX), Cincinnati Financial Corporation (NASDAQ:CINF), and Ultrapar Participacoes SA (ADR) (NYSE:UGP). This group of stocks’ market valuations are similar to AGU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTXS | 38 | 1425918 | -7 |

| BSMX | 9 | 24506 | 1 |

| CINF | 18 | 120933 | 1 |

| UGP | 10 | 87119 | 3 |

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $415 million. That figure was $226 million in AGU’s case. Citrix Systems, Inc. (NASDAQ:CTXS) is the most popular stock in this table. On the other hand Grupo Financero Sntdr Mxco SAB de CV ADR (NYSE:BSMX) is the least popular one with only 9 bullish hedge fund positions. Agrium Inc. (USA) (NYSE:AGU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CTXS might be a better candidate to consider taking a long position in.

Disclosure: None