Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards The Chemours Company (NYSE:CC) changed recently.

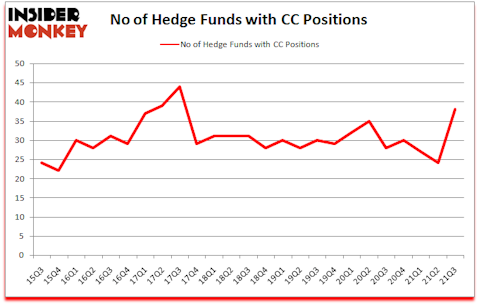

Is The Chemours Company (NYSE:CC) a healthy stock for your portfolio? Prominent investors were becoming more confident. The number of long hedge fund bets increased by 14 in recent months. The Chemours Company (NYSE:CC) was in 38 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 44. Our calculations also showed that CC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to take a gander at the latest hedge fund action encompassing The Chemours Company (NYSE:CC).

David Einhorn of Greenlight Capital

Do Hedge Funds Think CC Is A Good Stock To Buy Now?

At the end of September, a total of 38 of the hedge funds tracked by Insider Monkey were long this stock, a change of 58% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CC over the last 25 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Sessa Capital held the most valuable stake in The Chemours Company (NYSE:CC), which was worth $258 million at the end of the third quarter. On the second spot was Greenlight Capital which amassed $67.5 million worth of shares. Miller Value Partners, Luminus Management, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sessa Capital allocated the biggest weight to The Chemours Company (NYSE:CC), around 12.68% of its 13F portfolio. Brightline Capital is also relatively very bullish on the stock, designating 9.67 percent of its 13F equity portfolio to CC.

Consequently, some big names have been driving this bullishness. Renaissance Technologies, initiated the most outsized position in The Chemours Company (NYSE:CC). Renaissance Technologies had $15.6 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $14.5 million position during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Zilvinas Mecelis’s Covalis Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Chemours Company (NYSE:CC) but similarly valued. These stocks are National Fuel Gas Company (NYSE:NFG), Adaptive Biotechnologies Corporation (NASDAQ:ADPT), Dada Nexus Limited (NASDAQ:DADA), Blackstone Mortgage Trust Inc (NYSE:BXMT), Seaboard Corporation (NYSE:SEB), Premier Inc (NASDAQ:PINC), and SL Green Realty Corp (NYSE:SLG). This group of stocks’ market values are similar to CC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NFG | 19 | 152900 | 7 |

| ADPT | 25 | 1775850 | -2 |

| DADA | 13 | 106594 | -5 |

| BXMT | 15 | 182001 | 3 |

| SEB | 13 | 103287 | 0 |

| PINC | 19 | 191763 | 2 |

| SLG | 17 | 170228 | -4 |

| Average | 17.3 | 383232 | 0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.3 hedge funds with bullish positions and the average amount invested in these stocks was $383 million. That figure was $549 million in CC’s case. Adaptive Biotechnologies Corporation (NASDAQ:ADPT) is the most popular stock in this table. On the other hand Dada Nexus Limited (NASDAQ:DADA) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks The Chemours Company (NYSE:CC) is more popular among hedge funds. Our overall hedge fund sentiment score for CC is 85.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Unfortunately CC wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on CC were disappointed as the stock returned 3% since the end of the third quarter (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Chemours Co (NYSE:CC)

Follow Chemours Co (NYSE:CC)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top Chinese Companies on NASDAQ

- 25 Highest Earning Billionaires in 2020

- 11 Largest Aerospace Companies in America

Disclosure: None. This article was originally published at Insider Monkey.