Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Is Texas Pacific Land Trust (NYSE:TPL) the right investment to pursue these days? The smart money is buying. The number of bullish hedge fund bets advanced by 1 recently. Our calculations show that the company was not one of the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are viewed as slow, old investment tools of the past. While there are greater than 8000 funds trading at present, Our experts choose to focus on the elite of this club, about 700 funds. These money managers shepherd the majority of the hedge fund industry’s total capital, and by keeping track of their finest investments, Insider Monkey has unearthed various investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

While collecting data for our write-up, we tracked down the opinion of Horizon Kinetics LLC, a fund that is long on the stock. In its 4th Quarter Shareholder Letter, the fund said this:

“Texas Pacific Land Trust (“TPL”, or “The Trust”) was created in the late 19th century as part of a railway bankruptcy reorganization in which bondholders received interests in the Trust, which held approximately 3.5 millions of acres of land located in western Texas that were put up as collateral against the bonds. The governing document requires any income (earned, variously, from easement/sundry and grazing fees, periodic land sales, and oil and gas royalties generated by mining and energy companies active on the acreage) to be applied to the repurchase of shares and to pay dividends (which have, historically, been modest). There is a precedent, however, for value-enhancing transactions. The Trust’s main assets fall into three categories: Land, Mineral Rights, and Water.”

Let’s take a glance at the key hedge fund action regarding Texas Pacific Land Trust (NYSE:TPL).

Hedge fund activity in Texas Pacific Land Trust (NYSE:TPL)

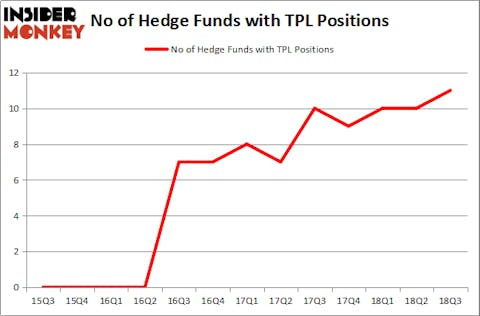

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in TPL at the beginning of this year. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Texas Pacific Land Trust (NYSE:TPL) was held by Horizon Asset Management, which reported holding $1578 million worth of stock at the end of September. It was followed by Polar Capital with a $24.7 million position. Other investors bullish on the company included Arrowstreet Capital, White Elm Capital, and Renaissance Technologies.

Consequently, key hedge funds have been driving this bullishness. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, created the most outsized position in Texas Pacific Land Trust (NYSE:TPL). Polar Capital had $24.7 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Texas Pacific Land Trust (NYSE:TPL) but similarly valued. These stocks are MarketAxess Holdings Inc. (NASDAQ:MKTX), AptarGroup, Inc. (NYSE:ATR), US Foods Holding Corp. (NYSE:USFD), and Cullen/Frost Bankers, Inc. (NYSE:CFR). This group of stocks’ market values are closest to TPL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MKTX | 13 | 149475 | 2 |

| ATR | 13 | 69129 | 2 |

| USFD | 36 | 1176157 | -6 |

| CFR | 18 | 169671 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $391 million. That figure was $1653 million in TPL’s case. 0 is the most popular stock in this table. On the other hand MarketAxess Holdings Inc. (NASDAQ:MKTX) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Texas Pacific Land Trust (NYSE:TPL) is even less popular than MKTX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.