Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards New Media Investment Group Inc (NYSE:NEWM).

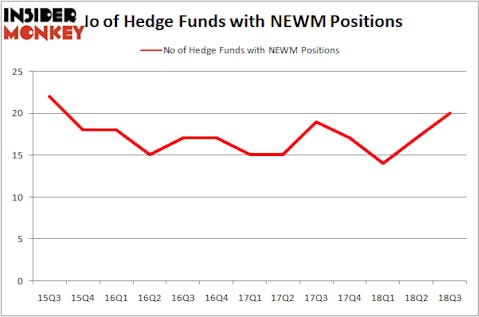

New Media Investment Group Inc (NYSE:NEWM) investors should pay attention to an increase in support from the world’s most elite money managers of late. Our calculations also showed that NEWM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the key hedge fund action surrounding New Media Investment Group Inc (NYSE:NEWM).

How are hedge funds trading New Media Investment Group Inc (NYSE:NEWM)?

Heading into the fourth quarter of 2018, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in NEWM heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Omega Advisors held the most valuable stake in New Media Investment Group Inc (NYSE:NEWM), which was worth $35.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $13.1 million worth of shares. Moreover, Maverick Capital, Citadel Investment Group, and D E Shaw were also bullish on New Media Investment Group Inc (NYSE:NEWM), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds have been driving this bullishness. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, created the biggest position in New Media Investment Group Inc (NYSE:NEWM). BlueCrest Capital Mgmt. had $0.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $0.6 million position during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp and Alec Litowitz and Ross Laser’s Magnetar Capital.

#N/A

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARR | 3 | 19432 | -2 |

| ASMB | 20 | 269945 | 1 |

| OSUR | 21 | 151915 | 4 |

| FLMN | 17 | 264186 | 3 |

| Average | 15.25 | 176370 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $176 million. That figure was $84 million in NEWM’s case. OraSure Technologies, Inc. (NASDAQ:OSUR) is the most popular stock in this table. On the other hand ARMOUR Residential REIT, Inc. (NYSE:ARR) is the least popular one with only 3 bullish hedge fund positions. New Media Investment Group Inc (NYSE:NEWM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OSUR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.