The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Mercury General Corporation (NYSE:MCY) .

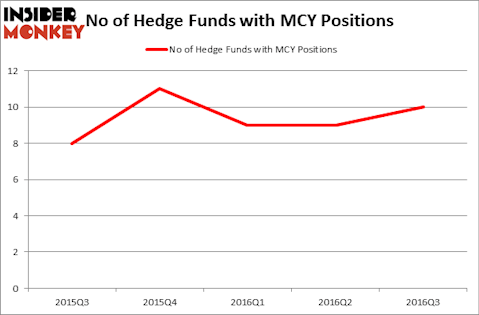

Is Mercury General Corporation (NYSE:MCY) a healthy stock for your portfolio? The best stock pickers are surely getting more optimistic. The number of long hedge fund positions that are disclosed in regulatory 13F filings swelled by 1 recently. MCY was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 9 hedge funds in our database with MCY positions at the end of the previous quarter. At the end of this article we will also compare MCY to other stocks including AMC Entertainment Holdings Inc (NYSE:AMC), Starz (NASDAQ:STRZA), and Cotiviti Holdings Inc(NYSE:COTV) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ilikestudio/Shutterstock.com

Now, we’re going to review the recent action regarding Mercury General Corporation (NYSE:MCY).

What does the smart money think about Mercury General Corporation (NYSE:MCY)?

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in MCY over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world has the most valuable position in Mercury General Corporation (NYSE:MCY), worth close to $16.7 million. The second largest stake is held by Chuck Royce of Royce & Associates which holds a $6.6 million position. Other peers that are bullish contain Ken Griffin’s Citadel Investment Group, Israel Englander’s Millennium Management and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, some big names were breaking ground themselves. Dmitry Balyasny’s Balyasny Asset Management assembled the biggest position in Mercury General Corporation (NYSE:MCY). Balyasny Asset Management had $1.1 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $1.1 million investment in the stock during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors and Mike Vranos’ Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to Mercury General Corporation (NYSE:MCY). We will take a look at AMC Entertainment Holdings Inc (NYSE:AMC), Starz (NASDAQ:STRZA), Cotiviti Holdings Inc(NYSE:COTV), and EnLink Midstream LLC (NYSE:ENLC). This group of stocks’ market values resemble MCY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMC | 15 | 133907 | -1 |

| STRZA | 28 | 470317 | -7 |

| COTV | 8 | 70845 | -3 |

| ENLC | 8 | 23951 | 3 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $175 million. That figure was $33 million in MCY’s case. Starz (NASDAQ:STRZA) is the most popular stock in this table. On the other hand Cotiviti Holdings Inc(NYSE:COTV) is the least popular one with only 8 bullish hedge fund positions. Mercury General Corporation (NYSE:MCY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard STRZA might be a better candidate to consider taking a long position in.

Disclosure: None