In this article we will check out the progression of hedge fund sentiment towards Jounce Therapeutics, Inc. (NASDAQ:JNCE) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

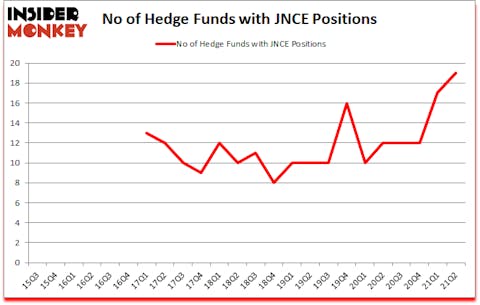

Jounce Therapeutics, Inc. (NASDAQ:JNCE) has experienced an increase in activity from the world’s largest hedge funds of late. Jounce Therapeutics, Inc. (NASDAQ:JNCE) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 17. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that JNCE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ken Griffin of Citadel Investment Group

Now let’s take a look at the key hedge fund action surrounding Jounce Therapeutics, Inc. (NASDAQ:JNCE).

Do Hedge Funds Think JNCE Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the first quarter of 2020. By comparison, 12 hedge funds held shares or bullish call options in JNCE a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Partner Fund Management was the largest shareholder of Jounce Therapeutics, Inc. (NASDAQ:JNCE), with a stake worth $22.2 million reported as of the end of June. Trailing Partner Fund Management was Adage Capital Management, which amassed a stake valued at $16.5 million. OrbiMed Advisors, Citadel Investment Group, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SilverArc Capital allocated the biggest weight to Jounce Therapeutics, Inc. (NASDAQ:JNCE), around 0.76% of its 13F portfolio. Partner Fund Management is also relatively very bullish on the stock, setting aside 0.7 percent of its 13F equity portfolio to JNCE.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the biggest position in Jounce Therapeutics, Inc. (NASDAQ:JNCE). Marshall Wace LLP had $1.7 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $0.5 million investment in the stock during the quarter. The following funds were also among the new JNCE investors: Greg Eisner’s Engineers Gate Manager and Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital).

Let’s now review hedge fund activity in other stocks similar to Jounce Therapeutics, Inc. (NASDAQ:JNCE). These stocks are EVI Industries Inc (NYSE:EVI), Corvus Gold Inc. (NASDAQ:KOR), Fortress Biotech Inc (NASDAQ:FBIO), Radiant Logistics, Inc. (NYSE:RLGT), Nature’s Sunshine Products Inc (NASDAQ:NATR), Covenant Logistics Group, Inc. (NASDAQ:CVLG), and Civista Bancshares, Inc. (NASDAQ:CIVB). All of these stocks’ market caps match JNCE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVI | 2 | 18114 | -2 |

| KOR | 2 | 63616 | 0 |

| FBIO | 8 | 42070 | 2 |

| RLGT | 18 | 24674 | 5 |

| NATR | 11 | 74758 | 2 |

| CVLG | 9 | 14190 | -3 |

| CIVB | 10 | 11327 | 0 |

| Average | 8.6 | 35536 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.6 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $81 million in JNCE’s case. Radiant Logistics, Inc. (NYSE:RLGT) is the most popular stock in this table. On the other hand EVI Industries Inc (NYSE:EVI) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Jounce Therapeutics, Inc. (NASDAQ:JNCE) is more popular among hedge funds. Our overall hedge fund sentiment score for JNCE is 87. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 24% in 2021 through October 22nd but still managed to beat the market by 1.6 percentage points. Hedge funds were also right about betting on JNCE as the stock returned 32.4% since the end of June (through 10/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Jounce Therapeutics Inc. (NASDAQ:JNCE)

Follow Jounce Therapeutics Inc. (NASDAQ:JNCE)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top Pharmaceutical Companies in India

- 25 Best Caribbean islands to visit during COVID

- 10 Best Money Saving Tips

Disclosure: None. This article was originally published at Insider Monkey.