The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Investment Technology Group (NYSE:ITG) from the perspective of those successful funds.

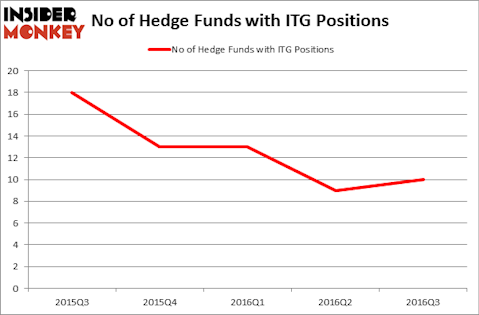

Investment Technology Group (NYSE:ITG) investors should pay attention to an increase in support from the world’s most successful money managers lately. There were 9 hedge funds in our database with ITG holdings at the end of the previous quarter. At the end of this article we will also compare ITG to other stocks including American Renal Associates Holdings Inc (NYSE:ARA), Atwood Oceanics, Inc. (NYSE:ATW), and Keryx Biopharmaceuticals (NASDAQ:KERX) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

With all of this in mind, let’s view the recent action surrounding Investment Technology Group (NYSE:ITG).

How are hedge funds trading Investment Technology Group (NYSE:ITG)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in ITG heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Paul Reeder and Edward Shapiro of PAR Capital Management holds the most valuable position in Investment Technology Group (NYSE:ITG) which has a $11.1 million position in the stock. The second most bullish fund manager is J. Daniel Plants’ Voce Capital which holds a $8.6 million position; 11% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism comprise Israel Englander’s Millennium Management which is one of the 10 largest hedge funds in the world, Jim Simons’ Renaissance Technologies and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.