A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31st, so let’s proceed with the discussion of the hedge fund sentiment on Evolent Health Inc (NYSE:EVH).

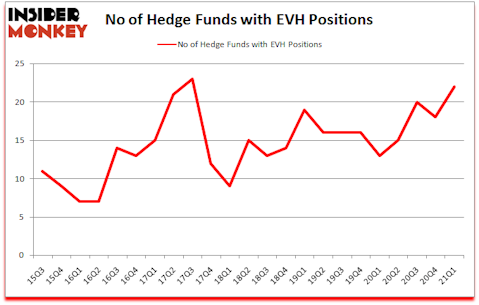

Is Evolent Health Inc (NYSE:EVH) the right investment to pursue these days? Hedge funds were taking a bullish view. The number of bullish hedge fund positions rose by 4 recently. Evolent Health Inc (NYSE:EVH) was in 22 hedge funds’ portfolios at the end of March. The all time high for this statistic is 23. Our calculations also showed that EVH isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Glenn Welling of Engaged Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to check out the fresh hedge fund action regarding Evolent Health Inc (NYSE:EVH).

Do Hedge Funds Think EVH Is A Good Stock To Buy Now?

At first quarter’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in EVH a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Glenn W. Welling’s Engaged Capital has the number one position in Evolent Health Inc (NYSE:EVH), worth close to $172.8 million, comprising 12.5% of its total 13F portfolio. On Engaged Capital’s heels is Sectoral Asset Management, managed by Jerome Pfund and Michael Sjostrom, which holds a $35.3 million position; 2.7% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish encompass Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Peter S. Park’s Park West Asset Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Engaged Capital allocated the biggest weight to Evolent Health Inc (NYSE:EVH), around 12.48% of its 13F portfolio. Courage Capital is also relatively very bullish on the stock, dishing out 6.61 percent of its 13F equity portfolio to EVH.

As industrywide interest jumped, some big names have been driving this bullishness. Rock Springs Capital Management, managed by Kris Jenner, Gordon Bussard, Graham McPhail, initiated the most valuable position in Evolent Health Inc (NYSE:EVH). Rock Springs Capital Management had $29.2 million invested in the company at the end of the quarter. Peter S. Park’s Park West Asset Management also initiated a $17.7 million position during the quarter. The following funds were also among the new EVH investors: Justin John Ferayorni’s Tamarack Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Evolent Health Inc (NYSE:EVH). These stocks are NBT Bancorp Inc. (NASDAQ:NBTB), Monmouth Real Estate Investment Corp. (NYSE:MNR), Sapiens International Corporation N.V. (NASDAQ:SPNS), Scholar Rock Holding Corporation (NASDAQ:SRRK), Provident Financial Services, Inc. (NYSE:PFS), Afya Limited (NASDAQ:AFYA), and Victory Capital Holdings, Inc. (NASDAQ:VCTR). This group of stocks’ market caps are similar to EVH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBTB | 6 | 10908 | -5 |

| MNR | 13 | 58825 | 1 |

| SPNS | 12 | 46366 | -2 |

| SRRK | 14 | 170425 | 0 |

| PFS | 11 | 24090 | 0 |

| AFYA | 5 | 11779 | -3 |

| VCTR | 14 | 86482 | 2 |

| Average | 10.7 | 58411 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.7 hedge funds with bullish positions and the average amount invested in these stocks was $58 million. That figure was $344 million in EVH’s case. Scholar Rock Holding Corporation (NASDAQ:SRRK) is the most popular stock in this table. On the other hand Afya Limited (NASDAQ:AFYA) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Evolent Health Inc (NYSE:EVH) is more popular among hedge funds. Our overall hedge fund sentiment score for EVH is 87.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still managed to beat the market by 7.7 percentage points. Hedge funds were also right about betting on EVH, though not to the same extent, as the stock returned 10% since the end of March (through July 16th) and outperformed the market as well.

Follow Evolent Health Inc. (NYSE:EVH)

Follow Evolent Health Inc. (NYSE:EVH)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Cheapest Online Shopping Sites in USA

- 10 Best Affordable Tech Stocks to Invest In Now

- Bill Gates’ Most Recent Investments

Disclosure: None. This article was originally published at Insider Monkey.