Is Msci Inc (NYSE:MSCI) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

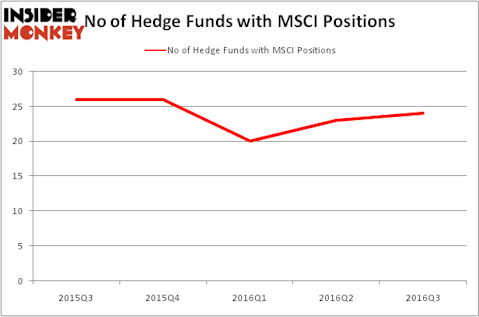

Msci Inc (NYSE:MSCI) shareholders have witnessed an increase in support from the world’s most elite money managers lately. MSCI was in 24 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with MSCI positions at the end of the previous quarter. At the end of this article we will also compare MSCI to other stocks including Ralph Lauren Corp (NYSE:RL), Sabre Corp (NASDAQ:SABR), and Foot Locker, Inc. (NYSE:FL) to get a better sense of its popularity.

Follow Msci Inc. (NYSE:MSCI)

Follow Msci Inc. (NYSE:MSCI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ZIDO SUN/Shutterstock.com

What does the smart money think about Msci Inc (NYSE:MSCI)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 4% uptick from one quarter earlier. While ownership of the stock among hedge funds has rebounded over the past 2 quarters, it has yet to return to its 2015 levels. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Darsana Capital Partners, managed by Anand Desai, holds the number one position in Msci Inc (NYSE:MSCI). Darsana Capital Partners has a $176.3 million position in the stock, comprising 8.8% of its 13F portfolio. The second most bullish fund manager is Cliff Asness of AQR Capital Management, with a $68.4 million position. Other professional money managers that hold long positions comprise Philip Uhde’s Echinus Advisors, D E Shaw, and Michael R. Weisberg’s Crestwood Capital Management.

Now, some big names have jumped into Msci Inc (NYSE:MSCI) headfirst. Magnetar Capital, managed by Alec Litowitz and Ross Laser, initiated the biggest position in Msci Inc (NYSE:MSCI). Magnetar Capital had $1.4 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $1.1 million position during the quarter. The following funds were also among the new MSCI investors: George Hall’s Clinton Group and Mike Vranos’ Ellington.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Msci Inc (NYSE:MSCI) but similarly valued. These stocks are Ralph Lauren Corp (NYSE:RL), Sabre Corp (NASDAQ:SABR), Foot Locker, Inc. (NYSE:FL), and InterContinental Hotels Group PLC (ADR) (NYSE:IHG). All of these stocks’ market caps match MSCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RL | 25 | 574190 | -7 |

| SABR | 29 | 1947191 | -7 |

| FL | 29 | 1018572 | -2 |

| IHG | 6 | 8885 | -1 |

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $887 million. That figure was $350 million in MSCI’s case. Sabre Corp (NASDAQ:SABR) is the most popular stock in this table. On the other hand InterContinental Hotels Group PLC (ADR) (NYSE:IHG) is the least popular one with only 6 bullish hedge fund positions. Msci Inc (NYSE:MSCI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FL might be a better candidate to consider for a long position.

Disclosure: None