Is Watts Water Technologies Inc (NYSE:WTS) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

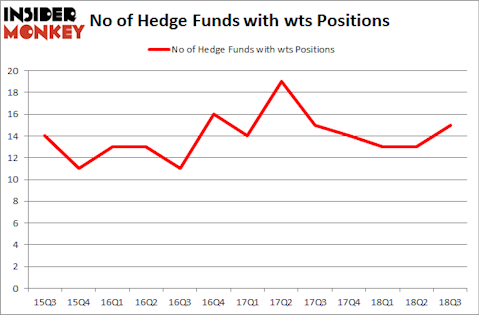

Watts Water Technologies Inc (NYSE:WTS) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that wts isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the recent hedge fund action encompassing Watts Water Technologies Inc (NYSE:WTS).

How have hedgies been trading Watts Water Technologies Inc (NYSE:WTS)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in WTS at the beginning of this year. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in Watts Water Technologies Inc (NYSE:WTS) was held by Impax Asset Management, which reported holding $199.2 million worth of stock at the end of September. It was followed by GAMCO Investors with a $98.8 million position. Other investors bullish on the company included Renaissance Technologies, GLG Partners, and Millennium Management.

Consequently, key money managers have jumped into Watts Water Technologies Inc (NYSE:WTS) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the largest position in Watts Water Technologies Inc (NYSE:WTS). Balyasny Asset Management had $1 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $0.7 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Watts Water Technologies Inc (NYSE:WTS) but similarly valued. We will take a look at J&J Snack Foods Corp. (NASDAQ:JJSF), Omnicell, Inc. (NASDAQ:OMCL), The Hain Celestial Group, Inc. (NASDAQ:HAIN), and Brandywine Realty Trust (NYSE:BDN). This group of stocks’ market valuations are similar to WTS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JJSF | 10 | 85668 | 1 |

| OMCL | 5 | 33391 | -2 |

| HAIN | 23 | 536744 | 1 |

| BDN | 15 | 122144 | 2 |

| Average | 13.25 | 194487 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $194 million. That figure was $351 million in WTS’s case. The Hain Celestial Group, Inc. (NASDAQ:HAIN) is the most popular stock in this table. On the other hand Omnicell, Inc. (NASDAQ:OMCL) is the least popular one with only 5 bullish hedge fund positions. Watts Water Technologies Inc (NYSE:WTS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HAIN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.