Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

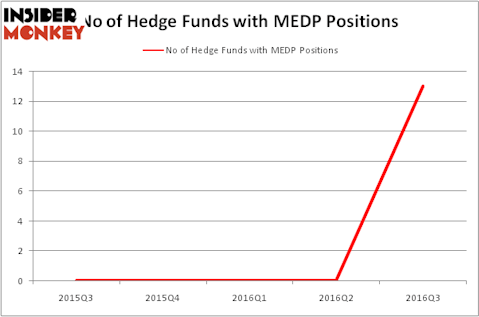

Medpace Holdings Inc (NASDAQ:MEDP) investors should be aware of an increase in hedge fund interest of late. There were 0 hedge funds in our database with MEDP positions at the end of the previous quarter, as the company completed its initial public offering (IPO) in August. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Nextera Energy Partners LP (NYSE:NEP), Schweitzer-Mauduit International, Inc. (NYSE:SWM), and BMC Stock Holdings Inc (NASDAQ:BMCH) to gather more data points.

Follow Medpace Holdings Inc. (NASDAQ:MEDP)

Follow Medpace Holdings Inc. (NASDAQ:MEDP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

With all of this in mind, we’re going to view the latest action surrounding Medpace Holdings Inc (NASDAQ:MEDP).

What does the smart money think about Medpace Holdings Inc (NASDAQ:MEDP)?

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who have initiated large positions in the company following its IPO.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Adage Capital Management, led by Phill Gross and Robert Atchinson, holds the largest position in Medpace Holdings Inc (NASDAQ:MEDP). According to regulatory filings, the fund has a $20.9 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Arthur B Cohen and Joseph Healey of Healthcor Management LP, with a $9.8 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions encompass Efrem Kamen’s Pura Vida Investments, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Michael Castor’s Sio Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.