Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Is Marvell Technology Group Ltd. (NASDAQ:MRVL) a worthy investment today? It looks like hedge funds are becoming more confident. The number of long hedge fund bets moved up by 12 to 50 during the third quarter. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as SVB Financial Group (NASDAQ:SIVB), Yamana Gold Inc. (USA) (NYSE:AUY), and East West Bancorp, Inc. (NASDAQ:EWBC) to gather more data points.

Follow Marvell Technology Group Ltd (NASDAQ:N/A)

Follow Marvell Technology Group Ltd (NASDAQ:N/A)

Receive real-time insider trading and news alerts

At the moment there are numerous indicators stock market investors employ to appraise publicly traded companies. A duo of the most useful indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outpace the S&P 500 by a very impressive amount (see the details here).

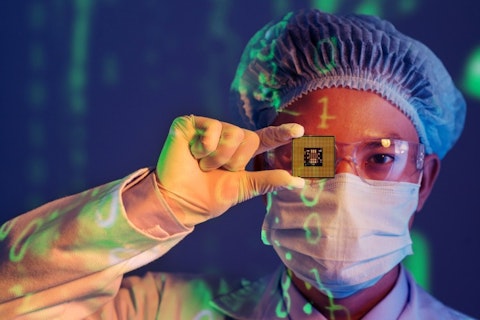

Dragon Images/Shutterstock.com

With all of this in mind, we’re going to take a look at the key action regarding Marvell Technology Group Ltd. (NASDAQ:MRVL).

How are hedge funds trading Marvell Technology Group Ltd. (NASDAQ:MRVL)?

At the end of the third quarter, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 32% from one quarter earlier. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Starboard Value LP, managed by Jeffrey Smith, holds the most valuable position in Marvell Technology Group Ltd. (NASDAQ:MRVL). Starboard Value LP has a $447.5 million position in the stock, comprising 12.2% of its 13F portfolio. Sitting at the No. 2 spot is Passport Capital, managed by John Burbank, which holds a $249.3 million stake; the fund has 5.2% of its 13F portfolio invested in the stock. Other peers that are bullish include Josh Resnick’s Jericho Capital Asset Management, Cliff Asness’ AQR Capital Management and Curtis Macnguyen’s Ivory Capital (Investment Mgmt).

As aggregate interest increased, key money managers have jumped into Marvell Technology Group Ltd. (NASDAQ:MRVL) headfirst. Passport Capital initiated the biggest position in Marvell Technology Group Ltd. (NASDAQ:MRVL). Josh Resnick’s Jericho Capital Asset Management also initiated a $130.6 million position during the quarter. The other funds with brand new MRVL positions are Steve Cohen’s Point72 Asset Management, Dmitry Balyasny’s Balyasny Asset Management, and David Harding’s Winton Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Marvell Technology Group Ltd. (NASDAQ:MRVL) but similarly valued. These stocks are SVB Financial Group (NASDAQ:SIVB), Yamana Gold Inc. (USA) (NYSE:AUY), East West Bancorp, Inc. (NASDAQ:EWBC), and Starwood Property Trust, Inc. (NYSE:STWD). This group of stocks’ market caps match MRVL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIVB | 19 | 501112 | -2 |

| AUY | 20 | 224711 | -4 |

| EWBC | 21 | 287737 | -1 |

| STWD | 21 | 416130 | 0 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $357 million. That figure was $1.71 billion in MRVL’s case. East West Bancorp, Inc. (NASDAQ:EWBC) is the most popular stock in this table. On the other hand SVB Financial Group (NASDAQ:SIVB) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Marvell Technology Group Ltd. (NASDAQ:MRVL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.