Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

At Home Group Inc. (NYSE:HOME) investors should pay attention to an increase in hedge fund interest lately. Our calculations also showed that HOME isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the recent hedge fund action regarding At Home Group Inc. (NYSE:HOME).

What have hedge funds been doing with At Home Group Inc. (NYSE:HOME)?

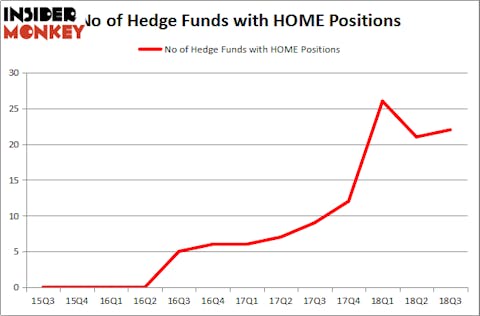

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in HOME at the beginning of this year. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Paul Reeder and Edward Shapiro’s PAR Capital Management has the number one position in At Home Group Inc. (NYSE:HOME), worth close to $45 million, comprising 0.5% of its total 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $32 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Mariko Gordon’s Daruma Asset Management, Jeffrey Hoffner’s Engle Capital and David Keidan’s Buckingham Capital Management.

As one would reasonably expect, key money managers have been driving this bullishness. Daruma Asset Management, managed by Mariko Gordon, initiated the most valuable position in At Home Group Inc. (NYSE:HOME). Daruma Asset Management had $26.6 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $16.2 million position during the quarter. The other funds with brand new HOME positions are Michael R. Weisberg’s Crestwood Capital Management, Ian Simm’s Impax Asset Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as At Home Group Inc. (NYSE:HOME) but similarly valued. We will take a look at Azul S.A. (NYSE:AZUL), Heartland Financial USA Inc (NASDAQ:HTLF), NetGear, Inc. (NASDAQ:NTGR), and Uxin Limited (NASDAQ:UXIN). This group of stocks’ market caps are closest to HOME’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZUL | 11 | 89027 | -10 |

| HTLF | 6 | 23461 | -1 |

| NTGR | 16 | 36926 | 0 |

| UXIN | 5 | 197910 | -7 |

| Average | 9.5 | 86831 | -4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $87 million. That figure was $222 million in HOME’s case. NetGear, Inc. (NASDAQ:NTGR) is the most popular stock in this table. On the other hand Uxin Limited (NASDAQ:UXIN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks At Home Group Inc. (NYSE:HOME) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.