It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Analog Devices, Inc. (NASDAQ:ADI).

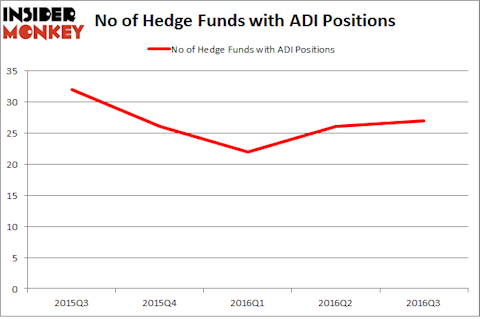

Is Analog Devices, Inc. (NASDAQ:ADI) a buy here? The best stock pickers are surely in an optimistic mood. The number of bullish hedge fund investments went up by 1 recently. There were 27 hedge funds in our database with ADI holdings at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as International Paper Company (NYSE:IP), Dollar General Corp. (NYSE:DG), and TELUS Corporation (USA) (NYSE:TU) to gather more data points.

Follow Analog Devices Inc (NASDAQ:ADI)

Follow Analog Devices Inc (NASDAQ:ADI)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

silvano audisio/Shutterstock.com

How are hedge funds trading Analog Devices, Inc. (NASDAQ:ADI)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 4% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in ADI at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cantillon Capital Management, led by William von Mueffling, holds the largest position in Analog Devices, Inc. (NASDAQ:ADI). Cantillon Capital Management has a $450.8 million position in the stock, comprising 6.4% of its 13F portfolio. On Cantillon Capital Management’s heels is Robert Rodriguez and Steven Romick of First Pacific Advisors LLC, with a $306.5 million position; the fund has 2.5% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions include D. E. Shaw’s D E Shaw, Panayotis Takis Sparaggis’ Alkeon Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names have jumped into Analog Devices, Inc. (NASDAQ:ADI) headfirst. Criterion Capital, led by Christopher Lord, initiated the biggest position in Analog Devices, Inc. (NASDAQ:ADI). Criterion Capital had $9.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $5.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Neil Chriss’ Hutchin Hill Capital, Lee Ainslie’s Maverick Capital, and Jonathan Dawson’s Southport Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Analog Devices, Inc. (NASDAQ:ADI) but similarly valued. These stocks are International Paper Company (NYSE:IP), Dollar General Corp. (NYSE:DG), TELUS Corporation (USA) (NYSE:TU), and Continental Resources, Inc. (NYSE:CLR). This group of stocks’ market caps are similar to ADI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IP | 33 | 457001 | 13 |

| DG | 53 | 1173695 | 0 |

| TU | 9 | 224564 | -3 |

| CLR | 44 | 712414 | 0 |

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $642 million. That figure was $1.28 billion in ADI’s case. Dollar General Corp. (NYSE:DG) is the most popular stock in this table. On the other hand TELUS Corporation (USA) (NYSE:TU) is the least popular one with only 9 bullish hedge fund positions. Analog Devices, Inc. (NASDAQ:ADI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DG might be a better candidate to consider taking a long position in.

Disclosure: None