The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Wheaton Precious Metals Corp. (NYSE:WPM) from the perspective of those elite funds.

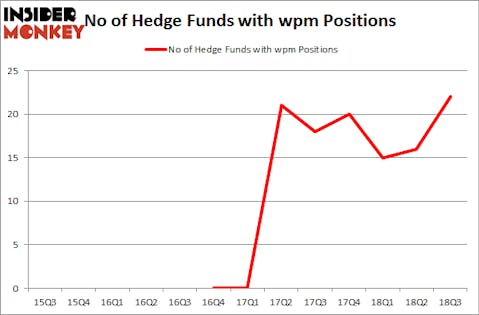

Is Wheaton Precious Metals Corp. (NYSE:WPM) a first-rate investment now? The smart money is buying. The number of bullish hedge fund positions advanced by 6 lately. Our calculations also showed that wpm isn’t among the 30 most popular stocks among hedge funds. WPM was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. There were 16 hedge funds in our database with WPM holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to take a glance at the key hedge fund action surrounding Wheaton Precious Metals Corp. (NYSE:WPM).

What does the smart money think about Wheaton Precious Metals Corp. (NYSE:WPM)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 38% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in WPM over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, David Iben’s Kopernik Global Investors has the largest position in Wheaton Precious Metals Corp. (NYSE:WPM), worth close to $55.5 million, accounting for 10.4% of its total 13F portfolio. Sitting at the No. 2 spot is Horizon Asset Management, led by Murray Stahl, holding a $52.2 million position; 1.3% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish consist of Cliff Asness’s AQR Capital Management, Jim Simons’s Renaissance Technologies and Israel Englander’s Millennium Management.

As one would reasonably expect, some big names have jumped into Wheaton Precious Metals Corp. (NYSE:WPM) headfirst. Caxton Associates LP, managed by Bruce Kovner, created the most outsized position in Wheaton Precious Metals Corp. (NYSE:WPM). Caxton Associates LP had $5.3 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $3.1 million investment in the stock during the quarter. The following funds were also among the new WPM investors: David Greenspan’s Slate Path Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now take a look at hedge fund activity in other stocks similar to Wheaton Precious Metals Corp. (NYSE:WPM). We will take a look at Graco Inc. (NYSE:GGG), Roku, Inc. (NASDAQ:ROKU), Israel Chemicals Ltd. (NYSE:ICL), and Pinnacle Foods Inc (NYSE:PF). All of these stocks’ market caps resemble WPM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GGG | 22 | 219077 | 6 |

| ROKU | 31 | 788092 | 8 |

| ICL | 8 | 40795 | 2 |

| PF | 35 | 2333165 | -11 |

| Average | 24 | 845282 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $845 million. That figure was $264 million in WPM’s case. Pinnacle Foods Inc (NYSE:PF) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 8 bullish hedge fund positions. Wheaton Precious Metals Corp. (NYSE:WPM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.