Is Viacom, Inc. (NASDAQ:VIAB) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

Is Viacom, Inc. (NASDAQ:VIAB) a good stock to buy now? Money managers are becoming hopeful. The number of long hedge fund positions improved by 6 lately. Our calculations also showed that viab isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are perceived as slow, old financial tools of years past. While there are more than 8,000 funds in operation at present, Our researchers look at the moguls of this club, around 700 funds. These money managers orchestrate the majority of the hedge fund industry’s total capital, and by observing their first-class stock picks, Insider Monkey has revealed a few investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

Let’s check out the latest hedge fund action encompassing Viacom, Inc. (NASDAQ:VIAB).

Hedge fund activity in Viacom, Inc. (NASDAQ:VIAB)

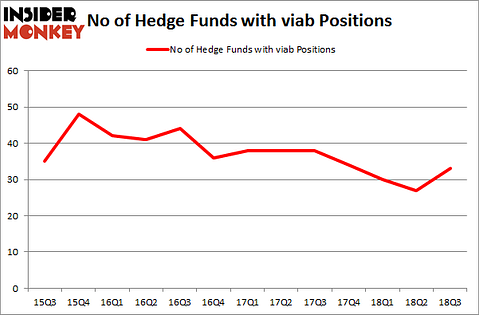

Heading into the fourth quarter of 2018, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VIAB over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Viacom, Inc. (NASDAQ:VIAB) was held by AQR Capital Management, which reported holding $192.9 million worth of stock at the end of September. It was followed by Ariel Investments with a $137.7 million position. Other investors bullish on the company included GAMCO Investors, Paulson & Co, and GAMCO Investors.

As industrywide interest jumped, key money managers have been driving this bullishness. Impax Asset Management, managed by Ian Simm, assembled the most valuable position in Viacom, Inc. (NASDAQ:VIAB). Impax Asset Management had $2.4 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $1.2 million position during the quarter. The following funds were also among the new VIAB investors: Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Mike Vranos’s Ellington.

Let’s check out hedge fund activity in other stocks similar to Viacom, Inc. (NASDAQ:VIAB). These stocks are EQT Corporation (NYSE:EQT), The J.M. Smucker Company (NYSE:SJM), New Oriental Education & Tech Group Inc. (NYSE:EDU), and Franco-Nevada Corporation (NYSE:FNV). This group of stocks’ market valuations match VIAB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQT | 45 | 2479699 | 5 |

| SJM | 26 | 428285 | 3 |

| EDU | 25 | 915138 | -7 |

| FNV | 16 | 365669 | 1 |

| Average | 28 | 1047198 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1.05 billion. That figure was $734 million in VIAB’s case. EQT Corporation (NYSE:EQT) is the most popular stock in this table. On the other hand Franco-Nevada Corporation (NYSE:FNV) is the least popular one with only 16 bullish hedge fund positions. Viacom, Inc. (NASDAQ:VIAB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EQT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.