The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards PRA Group, Inc. (NASDAQ:PRAA).

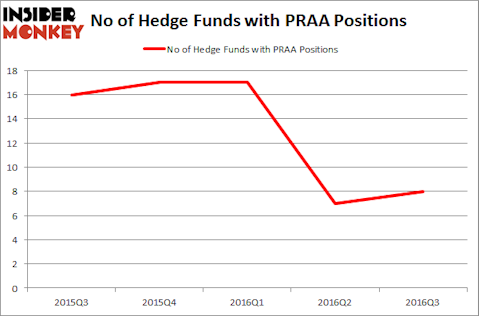

Is PRA Group, Inc. (NASDAQ:PRAA) a sound investment right now? Prominent investors are surely in an optimistic mood. The number of long hedge fund positions that are disclosed in regulatory 13F filings advanced by 1 recently. There were 8 hedge funds in our database with PRAA holdings at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV), Amedisys Inc (NASDAQ:AMED), and FBL Financial Group (NYSE:FFG) to gather more data points.

Follow Pra Group Inc (NASDAQ:PRAA)

Follow Pra Group Inc (NASDAQ:PRAA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zadorozhnyi Viktor/Shutterstock.com

Hedge fund activity in PRA Group, Inc. (NASDAQ:PRAA)

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 14% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in PRAA heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jonathan Bloomberg’s BloombergSen has the largest position in PRA Group, Inc. (NASDAQ:PRAA), worth close to $67.3 million, accounting for 6.6% of its total 13F portfolio. Coming in second is Gilchrist Berg of Water Street Capital, with a $41.6 million position; 1.6% of its 13F portfolio is allocated to the company. Some other peers that hold long positions contain John Osterweis’ Osterweis Capital Management, Cliff Asness’ AQR Capital Management and D E Shaw, one of the biggest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, some big names have been driving this bullishness. D E Shaw created the largest position in PRA Group, Inc. (NASDAQ:PRAA). D E Shaw had $0.9 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.7 million investment in the stock during the quarter. The only other fund with a new position in the stock is Sharif Siddiqui’s Alpenglow Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as PRA Group, Inc. (NASDAQ:PRAA) but similarly valued. We will take a look at Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV), Amedisys Inc (NASDAQ:AMED), FBL Financial Group (NYSE:FFG), and MRC Global Inc (NYSE:MRC). This group of stocks’ market valuations match PRAA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVV | 3 | 4448 | -1 |

| AMED | 14 | 81873 | -4 |

| FFG | 6 | 5826 | 1 |

| MRC | 20 | 231399 | -2 |

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $81 million. That figure was $115 million in PRAA’s case. MRC Global Inc (NYSE:MRC) is the most popular stock in this table. On the other hand Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV) is the least popular one with only 3 bullish hedge fund positions. PRA Group, Inc. (NASDAQ:PRAA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MRC might be a better candidate to consider taking a long position in.

Disclosure: None