After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards KLX Inc (NASDAQ:KLXI).

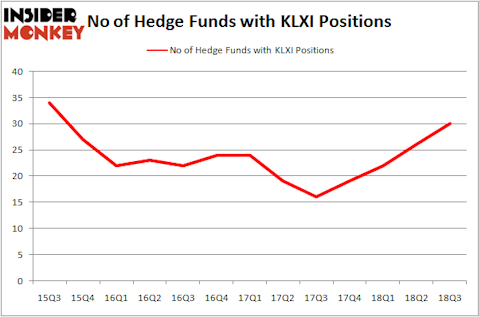

Is KLX Inc (NASDAQ:KLXI) going to take off soon? Hedge funds are buying. The number of bullish hedge fund positions moved up by 4 recently. Our calculations also showed that KLXI isn’t among the 30 most popular stocks among hedge funds. KLXI was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with KLXI positions at the end of the previous quarter.

To the average investor there are plenty of metrics stock traders put to use to analyze publicly traded companies. Some of the most innovative metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top money managers can outperform the S&P 500 by a significant amount (see the details here).

Let’s analyze the recent hedge fund action surrounding KLX Inc (NASDAQ:KLXI).

How are hedge funds trading KLX Inc (NASDAQ:KLXI)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in KLXI over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Robert Emil Zoellner’s Alpine Associates has the largest position in KLX Inc (NASDAQ:KLXI), worth close to $86.1 million, accounting for 2.4% of its total 13F portfolio. Coming in second is Water Island Capital, managed by John Orrico, which holds a $81.4 million position; the fund has 4.4% of its 13F portfolio invested in the stock. Some other peers with similar optimism comprise Tom Sandell’s Sandell Asset Management, Jim Simons’s Renaissance Technologies and Mario Gabelli’s GAMCO Investors.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Water Island Capital, managed by John Orrico, established the largest position in KLX Inc (NASDAQ:KLXI). Water Island Capital had $81.4 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $34.5 million position during the quarter. The other funds with new positions in the stock are Anand Parekh’s Alyeska Investment Group, Paul Glazer’s Glazer Capital, and James Dondero’s Highland Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as KLX Inc (NASDAQ:KLXI) but similarly valued. We will take a look at National Health Investors Inc (NYSE:NHI), Darling Ingredients Inc. (NYSE:DAR), Ocean Rig UDW Inc (NASDAQ:ORIG), and Greif, Inc. (NYSE:GEF). All of these stocks’ market caps are similar to KLXI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NHI | 10 | 73352 | -1 |

| DAR | 19 | 305835 | 4 |

| ORIG | 28 | 1808393 | 1 |

| GEF | 19 | 137228 | -1 |

| Average | 19 | 581202 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $581 million. That figure was $488 million in KLXI’s case. Ocean Rig UDW Inc (NASDAQ:ORIG) is the most popular stock in this table. On the other hand National Health Investors Inc (NYSE:NHI) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks KLX Inc (NASDAQ:KLXI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.