Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Kaiser Aluminum Corp. (NASDAQ:KALU) .

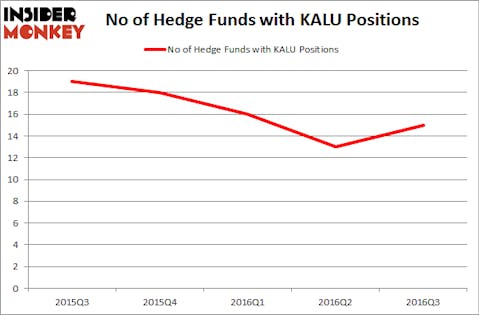

Kaiser Aluminum Corp. (NASDAQ:KALU) shareholders have witnessed an increase in hedge fund interest recently. KALU was in 15 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with KALU positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Stag Industrial Inc (NYSE:STAG), West Corp (NASDAQ:WSTC), and Cyberark Software Ltd (NASDAQ:CYBR) to gather more data points.

Follow Kaiser Aluminum Corp (NASDAQ:KALU)

Follow Kaiser Aluminum Corp (NASDAQ:KALU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

What does the smart money think about Kaiser Aluminum Corp. (NASDAQ:KALU)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 15% from the second quarter of 2016. On the other hand, there were a total of 18 hedge funds with a bullish position in KALU at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the largest position in Kaiser Aluminum Corp. (NASDAQ:KALU), worth close to $48.5 million. The second most bullish fund manager is Huber Capital Management, led by Joe Huber, which holds a $34.1 million position; 1.3% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that are bullish include Jim Simons’ Renaissance Technologies, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Michael Price’s MFP Investors. We should note that MFP Investors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key hedge funds were breaking ground themselves. Pine River Capital Management, led by Brian Taylor, created the largest position in Kaiser Aluminum Corp. (NASDAQ:KALU). Pine River Capital Management had $0.7 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $0.6 million investment in the stock during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Kaiser Aluminum Corp. (NASDAQ:KALU). These stocks are Stag Industrial Inc (NYSE:STAG), West Corp (NASDAQ:WSTC), Cyberark Software Ltd (NASDAQ:CYBR), and Diebold Incorporated (NYSE:DBD). All of these stocks’ market caps resemble KALU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STAG | 6 | 60320 | 0 |

| WSTC | 15 | 42460 | 2 |

| CYBR | 20 | 175177 | -2 |

| DBD | 19 | 288057 | 4 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $168 million in KALU’s case. Cyberark Software Ltd (NASDAQ:CYBR) is the most popular stock in this table. On the other hand Stag Industrial Inc (NYSE:STAG) is the least popular one with only 6 bullish hedge fund positions. Kaiser Aluminum Corp. (NASDAQ:KALU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CYBR might be a better candidate to consider taking a long position in.

Disclosure: None