“Market conditions are changing. The continued rise in interest rates suggests we are in the early stages of a bond bear market, which could intensify as central banks withdraw liquidity. The receding tide of liquidity will start to reveal more rocks beyond what has been exposed in emerging markets so far, and the value of a value discipline will be in avoiding the biggest capital-destroying rocks. If a rock emerges on the crowded shore of U.S. momentum, it could result in a major liquidity challenge, as momentum is often most intense on the downside as a crowded trade reverses. So investors are facing a large potential trade-off right now: continue to bet on the current dominance of momentum and the S&P 500, or bet on change and take an active value bet in names with attractive value and optionality, but with negative momentum,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Turquoise Hill Resources Ltd (NYSE:TRQ).

Turquoise Hill Resources Ltd (NYSE:TRQ) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of September. At the end of this article we will also compare TRQ to other stocks including MongoDB, Inc. (NASDAQ:MDB), Perspecta Inc. (NYSE:PRSP), and Range Resources Corp. (NYSE:RRC) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the key hedge fund action encompassing Turquoise Hill Resources Ltd (NYSE:TRQ).

Hedge fund activity in Turquoise Hill Resources Ltd (NYSE:TRQ)

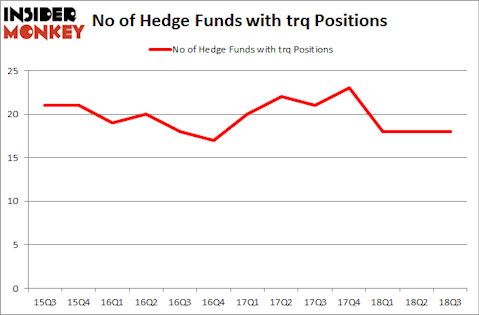

At the end of the third quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TRQ over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SailingStone Capital Partners held the most valuable stake in Turquoise Hill Resources Ltd (NYSE:TRQ), which was worth $582.3 million at the end of the third quarter. On the second spot was Pentwater Capital Management which amassed $270.9 million worth of shares. Moreover, Kopernik Global Investors, Anchor Bolt Capital, and Dalton Investments were also bullish on Turquoise Hill Resources Ltd (NYSE:TRQ), allocating a large percentage of their portfolios to this stock.

Due to the fact that Turquoise Hill Resources Ltd (NYSE:TRQ) has experienced a decline in interest from the smart money, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their entire stakes by the end of the third quarter. Interestingly, Ken Heebner’s Capital Growth Management sold off the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling close to $70.4 million in stock, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt. was right behind this move, as the fund cut about $2.9 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Turquoise Hill Resources Ltd (NYSE:TRQ) but similarly valued. These stocks are MongoDB, Inc. (NASDAQ:MDB), Perspecta Inc. (NYSE:PRSP), Range Resources Corp. (NYSE:RRC), and Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC). This group of stocks’ market valuations resemble TRQ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDB | 21 | 689313 | 2 |

| PRSP | 42 | 731268 | -8 |

| RRC | 29 | 1434168 | 4 |

| TKC | 8 | 12928 | 0 |

| Average | 25 | 716919 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $717 million. That figure was $1.01 billion in TRQ’s case. Perspecta Inc. (NYSE:PRSP) is the most popular stock in this table. On the other hand Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) is the least popular one with only 8 bullish hedge fund positions. Turquoise Hill Resources Ltd (NYSE:TRQ) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PRSP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.