Ariel Investments, an investment management company, released its “Ariel Mid Cap Value Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. US equities continued their rally in the third quarter, fueled by the Federal Reserve’s initial rate cut of the year, strong corporate earnings growth, and increased market participation. In the quarter, Ariel Mid Cap Value Composite returned +9.62% gross of fees (+9.47% net of fees) against this backdrop, significantly outperforming the +6.18% gain of the Russell Midcap Value Index and the +5.33% return of the Russell Midcap Index. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2025.

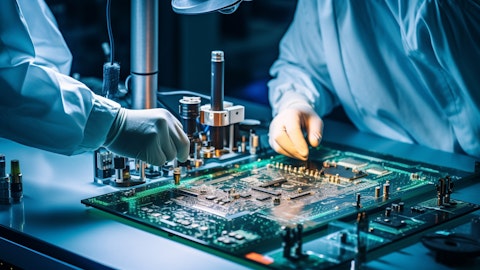

In its third-quarter 2025 investor letter, Ariel Mid Cap Value Strategy highlighted stocks such as Knowles Corporation (NYSE:KN). Knowles Corporation (NYSE:KN) provides capacitors, radio frequency (RF) filtering products, balanced armature speakers, micro-acoustic microphones, and audio solutions. The one-month return of Knowles Corporation (NYSE:KN) was -4.95%, and its shares gained 16.68% of their value over the last 52 weeks. On November 27, 2025, Knowles Corporation (NYSE:KN) stock closed at $22.45 per share, with a market capitalization of $1.928 billion.

Ariel Mid Cap Value Strategy stated the following regarding Knowles Corporation (NYSE:KN) in its third quarter 2025 investor letter:

“Additionally, Knowles Corporation (NYSE:KN), a leading provider of audio components and precision electrical devices, rose on the back of strong quarterly results. Demand remains healthy across key markets, with the Precision Devices segment returning to growth as channel inventories normalized and improved operational efficiency aided margins. The company also returned capital to shareholders through share repurchases. Longer-term, we believe KN remains well positioned to benefit from its focus on niche, market-leading positions in hearing health and precision devices.”

Knowles Corporation (NYSE:KN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 21 hedge fund portfolios held Knowles Corporation (NYSE:KN) at the end of the third quarter, which was 17 in the previous quarter. In Q3 2025, Knowles Corporation (NYSE:KN) reported revenue of $153 million, up 7% year-over-year. While we acknowledge the risk and potential of Knowles Corporation (NYSE:KN) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Knowles Corporation (NYSE:KN) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.