Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze HB Fuller Co (NYSE:FUL) from the perspective of those successful funds.

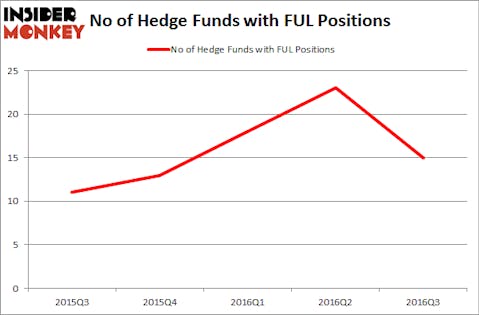

Is HB Fuller Co (NYSE:FUL) a worthy investment today? It looks like money managers are taking a pessimistic view. The number of bullish hedge fund positions slid by eight last quarter. In this way, 15 funds tracked by Insider Monkey were bullish on the company at the end of September. At the end of this article we will also compare FUL to other stocks including Copa Holdings, S.A. (NYSE:CPA), U.S. Silica Holdings Inc (NYSE:SLCA), and Cousins Properties Inc (NYSE:CUZ) to get a better sense of its popularity.

Follow Fuller H B Co (NYSE:FUL)

Follow Fuller H B Co (NYSE:FUL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SUWIT NGAOKAEW/Shutterstock.com

Keeping this in mind, let’s review the fresh action surrounding HB Fuller Co (NYSE:FUL).

How have hedgies been trading HB Fuller Co (NYSE:FUL)?

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, down by 35% from the end of the second quarter. Below, you can check out the change in hedge fund sentiment towards FUL over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Mariko Gordon’s Daruma Asset Management has the number one position in HB Fuller Co (NYSE:FUL), worth close to $45.4 million, accounting for 2.8% of its total 13F portfolio. The second largest stake is held by GAMCO Investors, led by Mario Gabelli, holding a $30.3 million position; 0.2% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism comprise Anand Parekh’s Alyeska Investment Group, Jim Simons’ Renaissance Technologies, and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that HB Fuller Co (NYSE:FUL) has weathered bearish sentiment from the smart money, it’s easy to see that there exists a select few funds who sold off their full holdings last quarter. It’s worth mentioning that Israel Englander’s Millennium Management dropped the biggest investment of the 700 funds studied by Insider Monkey, comprising close to $7.6 million in stock, and Phill Gross and Robert Atchinson’s Adage Capital Management was right behind this move, as the fund sold off about $4.4 million worth of shares.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as HB Fuller Co (NYSE:FUL) but similarly valued. We will take a look at Copa Holdings, S.A. (NYSE:CPA), U.S. Silica Holdings Inc (NYSE:SLCA), Cousins Properties Inc (NYSE:CUZ), and Boston Beer Co Inc (NYSE:SAM). This group of stocks’ market values match FUL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPA | 16 | 246915 | 9 |

| SLCA | 39 | 750752 | 8 |

| CUZ | 9 | 31877 | -6 |

| SAM | 16 | 277663 | 3 |

As you can see these stocks had an average of 20 investors with long positions and the average amount invested in these stocks was $327 million, which is higher than the $110 million figure in FUL’s case. U.S. Silica Holdings Inc (NYSE:SLCA) is the most popular stock in this table. On the other hand Cousins Properties Inc (NYSE:CUZ) is the least popular one with only nine bullish hedge fund positions. HB Fuller Co (NYSE:FUL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard U.S. Silica Holdings Inc (NYSE:SLCA) might be a better candidate to consider taking a long position in.

Disclosure: none