At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

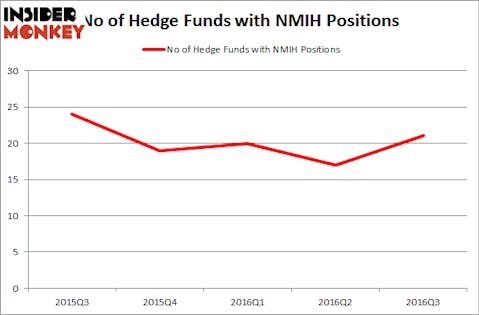

NMI Holdings Inc (NASDAQ:NMIH) has experienced an increase in enthusiasm from smart money lately. NMIH was in 21 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with NMIH positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as DICE HOLDINGS, INC. (NYSE:DHX), Flexion Therapeutics Inc (NASDAQ:FLXN), and Natural Health Trends Corp. (NASDAQ:NHTC) to gather more data points.

Follow Nmi Holdings Inc. (NASDAQ:NMIH)

Follow Nmi Holdings Inc. (NASDAQ:NMIH)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

nito/Shutterstock.com

How have hedgies been trading NMI Holdings Inc (NASDAQ:NMIH)?

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a 24% rise from the second quarter of 2016, though the number of hedge funds long the stock still sits below its yearly high. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Oaktree Capital Management, managed by Howard Marks, holds the largest position in NMI Holdings Inc (NASDAQ:NMIH). Oaktree Capital Management has a $44.3 million position in the stock. The second largest stake is held by Hayman Advisors, led by Kyle Bass, holding a $37.5 million position; 59.1% of its 13F portfolio is allocated to the company. Other professional money managers with similar optimism comprise Shawn Bergerson and Martin Kalish’s Waterstone Capital Management, Jim Simons’ Renaissance Technologies and Matthew Barrett’s Glendon Capital Management.

As aggregate interest increased, some big names have been driving this bullishness. Mangrove Partners, managed by Nathaniel August, established the largest position in NMI Holdings Inc (NASDAQ:NMIH). Mangrove Partners had $4.6 million invested in the company at the end of the quarter. Mark Coe’s Coe Capital Management also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Cliff Asness’ AQR Capital Management, Mike Vranos’ Ellington, and Chao Ku’s Nine Chapters Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as NMI Holdings Inc (NASDAQ:NMIH) but similarly valued. We will take a look at DICE HOLDINGS, INC. (NYSE:DHX), Flexion Therapeutics Inc (NASDAQ:FLXN), Natural Health Trends Corp. (NASDAQ:NHTC), and Bill Barrett Corporation (NYSE:BBG). This group of stocks’ market valuations are closest to NMIH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHX | 17 | 28977 | 0 |

| FLXN | 8 | 40444 | -3 |

| NHTC | 10 | 39773 | 0 |

| BBG | 19 | 87696 | 0 |

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $146 million in NMIH’s case. Bill Barrett Corporation (NYSE:BBG) is the most popular stock in this table. On the other hand Flexion Therapeutics Inc (NASDAQ:FLXN) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks NMI Holdings Inc (NASDAQ:NMIH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None