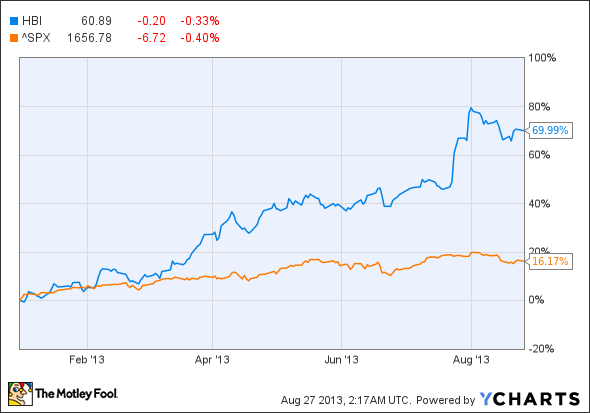

Hanesbrands Inc. (NYSE:HBI) owns a number of famous brands and sells its products directly to customers through a chain of more than 200 stores, as well as online. The stock has done well this year, rising almost 70% compared to about a 16% uptick in the S&P 500 index, but it still looks cheap with a trailing P/E of under 17x.

Moreover, given the company’s solid strategies and execution, the stock might appreciate further, as evidenced by recently-reported quarterly results. Revenue increased by 2% to $1.2 billion primarily due to increased sales in the inner-wear segment.

The success of Hanesbrands Inc. (NYSE:HBI)’s “Innovate to Elevate” strategy led to a 51% increase in operating profit to $181.4 million, as compared to $119.9 million in the year-ago quarter. In addition, lower cotton costs also helped. As a result, EPS advanced 78% from the year-ago quarter to $1.19 and beat consensus estimates of $0.94.

Another acquisition and a good strategy

Hanesbrands Inc. (NYSE:HBI) has always eyed mergers and acquisitions for growth. Years ago, it purchased Gear For Sports, and that worked out well for company. It recently acquired Maidenform Brands, Inc. (NYSE:MFB), which will add brands like Maidenform, Flexees, and Self Expressions to its already comprehensive portfolio. Hanesbrands Inc. (NYSE:HBI) did well in the inner-wear segment in the reported quarter, and with this acquisition it is expects to keep the momentum intact.

Maidenform Brands, Inc. (NYSE:MFB) delivered a profit but missed consensus estimates on both earnings and revenue in the most recent quarter. Also, analysts have a neutral outlook as far as next quarter’s performance is concerned. Maidenform Brands, Inc. (NYSE:MFB) struggled as a result of cheaper competition in the women’s underwear business. The company had to resort to discounts and heavy advertising to compete. It is expected, however, that the synergies as a result of the acquisition by Hanesbrands Inc. (NYSE:HBI) will lead to lower costs and contribute to earnings.

Hanesbrands Inc. (NYSE:HBI) ranks second in terms of underwear market share, at 14.3% of the market. Maidenform Brands, Inc. (NYSE:MFB) ranks fifth with 2.5%. The combined company will be one of the leading underwear companies. As a result of the acquisition, Hanesbrands gets a big portfolio of brands, which implies more leverage and pricing power with retailers ranging from Wal-Mart to Macy’s.

It also expects that the adjusted annual revenue will exceed $5 billion within three years, thereby producing $0.60 per share in earnings going forward. This will also benefit Hanesbrands with a larger market share within the shape-wear industry.