It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Groupon Inc (NASDAQ:GRPN).

Hedge fund interest in Groupon Inc (NASDAQ:GRPN) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare GRPN to other stocks including Balchem Corporation (NASDAQ:BCPC), Western Refining, Inc. (NYSE:WNR), and Universal Forest Products, Inc. (NASDAQ:UFPI) to get a better sense of its popularity.

Follow Groupon Inc. (NASDAQ:GRPN)

Follow Groupon Inc. (NASDAQ:GRPN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Lisa S./Shutterstock.com

With all of this in mind, let’s take a look at the recent action encompassing Groupon Inc (NASDAQ:GRPN).

Hedge fund activity in Groupon Inc (NASDAQ:GRPN)

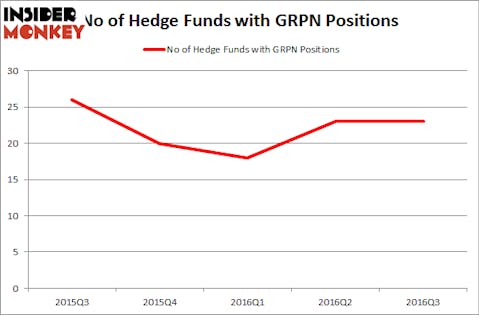

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from one quarter earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’ Renaissance Technologies, holds the most valuable position in Groupon Inc (NASDAQ:GRPN). According to regulatory filings, the fund has a $113.6 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is David E. Shaw of D E Shaw, with a $36.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism include Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and Dmitry Balyasny’s Balyasny Asset Management.

Since Groupon Inc (NASDAQ:GRPN) has experienced no change in sentiment from the aggregate hedge fund industry, therefore we take a look at a certain “tier” of money managers who sold off their entire stakes last quarter. Interestingly, Marc Majzner’s Clearline Capital cut the largest investment of the 700 funds tracked by Insider Monkey, worth about $3.7 million in stock. Steve Cohen’s family office, Point72 Asset Management, also dropped its stock, about $3.5 million worth of GRPN shares. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Groupon Inc (NASDAQ:GRPN) but similarly valued. These stocks are Balchem Corporation (NASDAQ:BCPC), Western Refining, Inc. (NYSE:WNR), Universal Forest Products, Inc. (NASDAQ:UFPI), and Hawk Corporation (NYSE:HAWK). All of these stocks’ market caps resemble GRPN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCPC | 8 | 76191 | 1 |

| WNR | 27 | 300226 | 4 |

| UFPI | 14 | 83423 | -1 |

| HAWK | 31 | 327962 | 9 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $197 million. That figure was $257 million in GRPN’s case. Hawk Corporation (NYSE:HAWK) is the most popular stock in this table. On the other hand Balchem Corporation (NASDAQ:BCPC) is the least popular one with only 8 bullish hedge fund positions. Groupon Inc (NASDAQ:GRPN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HAWK might be a better candidate to consider a long position.

Disclosure: none.