The week ahead

This is a low-impact week in terms of scheduled data releases. Tomorrow, we’ll get earnings from retailing powerhouse Costco; on Wednesday, we’ll be able to weigh those results against national retail-sales numbers. Friday will see the release of consumer price inflation data for the month of February, along with a host of manufacturing-related indexes

Bursting the bubble

This morning, Reuters has an interesting piece on the decline of commodities profits at investment banks — particularly Goldman Sachs Group, Inc. (NYSE:GS) , where revenue from its commodities franchise has fallen 90% from its 2009 level of $4.5 billion, including a 60% drop last year. Dow component JPMorgan Chase & Co. (NYSE:JPM) is now thought to be the leading investment bank in commodities markets.

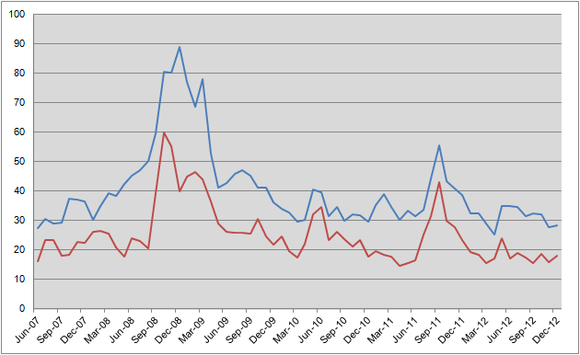

The reasons for this industrywide trend are twofold: restrictions on proprietary trading — trading for the bank’s own account — that are being introduced as part of the Dodd-Frank legislation and the drop in commodities market volatility. On the second point, the following monthly chart shows the CBOE Crude Oil Volatility Index (blue line) versus the VIX index (red line). Both indexes are calculated from option prices and reflect the market’s expectations for short-term volatility — the former for crude oil and the latter for the S&P 500.

Source: CBOE

Two observations here:

Volatility was lower in 2012 than in any 12-month period since the onset of the credit crisis in the second half of 2007.

The volatility of oil tracks that of stocks closely, reflecting the risk-on/risk-off dynamic that has dominated financial markets during the crisis and post-crisis eras.

Investment banks are notorious for their “boom-bust” approach to business, riding cyclical profit opportunities to the hilt until the opportunity dwindles and they are forced to retrench. If commodities markets continue to normalize and volatility remains muted, we could see another wave of savage job cuts at the investment banks.

With big finance firms still trading at deep discounts to their historic norms, investors everywhere are wondering if this is the new normal or if finance stocks are a screaming buy today. The answer depends on the company, so to help you figure out whether JPMorgan is a buy today, I invite you to read our premium research report on the company today. Click here now for instant access!

The article Has the Commodities Bubble Burst at Investment Banks? originally appeared on Fool.com and is written by Alex Dumortier, CFA.

Fool contributor Alex Dumortier, CFA has no position in any stocks mentioned; you can follow him on LinkedIn. The Motley Fool recommends Goldman Sachs. The Motley Fool owns shares of JPMorgan Chase & Co (NYSE:JPM).

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.