I think everyone understands that we are going to need to see that type of 12%-plus step function in efficiency the next-gen platform. And as we have in the past, we intend to have GE Aerospace at the forefront.

Operator: Our next question will come from the line of Noah Poponak with Goldman Sachs.

Noah Poponak: Can you hear me?

Rahul Ghai: We can.

Larry Culp: Good morning, loud and clear.

Noah Poponak: Hi. Sorry it cut out on my end. But, good morning everyone and let me add my congratulations to completing the spin. And Steve thanks a lot for all your help getting up to speed.

Steve Winoker: Thank you.

Noah Poponak: Rahul, could you spend another minute on the free cash in the quarter and for the full year. If you’re going to have any seasonality that looks like the company used to or the industry often does through the year, that number in the first quarter would imply a lot of upside to the five. I know you highlighted working capital, timing, it didn’t look like that big of a number in the quarter on an absolute basis. Maybe it’s just normally weaker. So yes, I guess how much bigger is the greater sign on the five now than it was before? Or did you just truly have pure timing in the quarter?

Rahul Ghai: Yes. So Noah, listen, good start on cash. Obviously, pleased. We doubled our free cash flow at Aerospace year-over-year. I would say, first, let’s just talk about the quarter. Two main drivers here: one was earnings growth, and second was working capital improvement, which kind of offset the AD&A headwind. And working capital in the quarter was a source of cash versus a use of cash last year. So that was a good turnaround from what we delivered. And the improvements we saw in the quarter came from a days sales outstanding that were down six days year-over-year and then progress payments that we got from customers. Inventory continues to be a challenge, given all the material availability, and so our WIP levels are high and the trapped inventory that we have increased as well.

So overall, earnings growth and working capital kind of drove the first quarter. And as you look at the full year, to your question on how – what’s changed versus our prior guide. As I said in my prepared remarks, we do expect the incremental earnings growth that we are driving to flow through to cash. So we increased the midpoint of our op profit by, call it, $150 million, so call it $100 million kind of post taxes. That should – our free cash should be up by that. Again, on a full year basis, same drivers of free cash. Earnings growth and working capital improvement will continue to be the two big drivers. I think the things that we are watching here, Noah, as you go into the second half of the year is going to be the inventory reduction that we can drive.

So that’s the one that’s – just given the supply chain challenges, given the demand dynamics with the air framers, so we continue to watch that inventory level and can we drive the same level of inventory reduction that we had initially planned that we’ve started the year. So again, good start. We expect about half the full year cash to be in the first half of the year. And then we do think that the earnings increase that we’ve driven should flow through our cash as well. And greater than 100% conversion, well above 100% for the year.

Operator: Our next question will come from the line of Matt Akers with Wells Fargo.

Matt Akers: Yes. Hi, good morning guys.

Larry Culp: Good morning.

Matt Akers: Can you touch a little bit more on the $650 million investment, just the benefits you expect to get from that? And it looks like there’s a lot of additive manufacturing in there. Can you just talk about that opportunity as well?

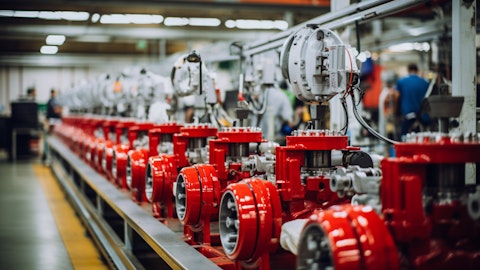

Larry Culp: Well, it really is a broad-based enhancement of our existing domestic footprint. I’m sure you’ve seen some of the line item details that were publicized locally across the country. I think more than anything, what we wanted to do was make sure we were supporting the fixed capital investments required to operationalize FLIGHT DECK to prepare for the capacity expansions and in some instances, be it additive or in some other technologies like CMCs that we were getting out ahead of demand to the fullest extent possible. Again, back to the reality of the skylines we talked about earlier. So that’s what we’ll do. That’s kind of the announcement that we made here recently. I’m sure there will be follow-on announcements as we continue to invest.

But the most important investments, I think we make are those that we make in our people. And much of what we do from a training development perspective, especially, vis-à-vis, FLIGHT DECK, is really geared toward making sure that the people who come in every day are able to do great work and put those fixed assets to their highest and best use.

Steve Winoker: Hey Liz, we have time for one last question.

Operator: This question will come from the line of Jason Gursky with Citi.

Jason Gursky: Yes. Same thing with Noah. Can you hear me all?

Rahul Ghai: We can.

Larry Culp: Very well. Good morning.

Jason Gursky: Yes. Okay. Does go quiet right before you’re allowed to go on the line. Hey Steve, thanks for all of the help over the last year or so. And Blair, look forward to working with you. I’m sure you’re listening in. Larry, a clarification point here and then just a really quick question. On the clarification side of things, I think in your commentary about volume on LEAP during your prepared remarks, you talked a little bit about the supply chain being a bit of a constraint there. So I want to make sure that that’s the case in addition to whatever is going on with Boeing. And then on the question side of things, the – just kind of curious how the customer tone is these days on the narrow-body side when with those airlines where you’re competing for slots against the Pratt & Whitney engine, whether the tone of those conversations is any more constructive for you in the competitive environment is looking more optimistic for you on head-to-head competition against the Pratt engine.

Thanks.

Larry Culp: Yes. I would say, as I think both Rahul and I have commented, that we’re well calibrated with Boeing on the LEAP-1B requirements. We’ll leave it to Dave and Brian to speak to the details tomorrow. I think as we look forward, not only with that engine, but others, the supply chain challenge that we’ve touched on in prior calls continues to be relevant. With respect to new business, I think if you look at our win rates, particularly in narrow-body space over the last several years, we’ve been very encouraged by the sequential trend, the upticks that we have seen there. And we will continue to work hard to earn the business that ought to come our way. No change in that posture whatsoever.

Steve Winoker: So Larry, any final comments?

Larry Culp: Steve, thank you. And again, thanks for everything. Yes, let me just close. I hope you see here that the GE Aerospace team is moving forward with a greater focus to invent the future of flight, to lift people up and bring them home safely. And with FLIGHT DECK as our foundation, I’m confident we will realize our full potential in service of our customers, employees and shareholders. We appreciate your time today and your interest in GE Aerospace.

Operator: Thank you, ladies and gentlemen. This concludes today’s conference. Thank you for participating. You may now disconnect.

Follow General Electric Co (NYSE:GE)

Follow General Electric Co (NYSE:GE)

Receive real-time insider trading and news alerts