The five components of the z-score are listed below:

The z-score is then calculated from these values as follows:

If this number is above 2.99 then the company is considered safe. Between 1.81 and 2.99 is the “grey zone,” where the company is not in immediate danger of bankruptcy but may be heading in that direction. Anything below 1.81 means that the company is distressed and has a good chance of going bankrupt within a few years.

These weightings and limits are completely empirical, not based on anything fundamental – they’re simply what works. The model has been extremely accurate in predicting bankruptcies, with a success rate around 80%-90% according to this research. It’s not perfect, but it is a helpful gauge of financial stability.

I’ll calculate the Altman z-score for three different companies that have had bankruptcy rumors swirling around them for quite some time. These companies are GameStop Corp. (NYSE:GME), Research In Motion Ltd (NASDAQ:BBRY), and Nokia Corporation (ADR) (NYSE:NOK).

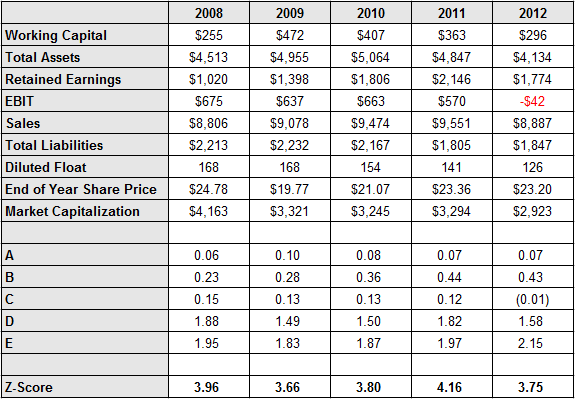

Gamestop

GameStop Corp. (NYSE:GME) sells new and used video game hardware, software, and accessories, and according to Morningstar holds an 80% share of the used video game market. In 2012 the company saw revenue and profitability decline, and in 2013 about 250 unprofitable or marginally profitable stores will be closed. Any time there are store closings people start to speculate on the fate of the company, and many seem to think that GameStop Corp. (NYSE:GME) is doomed. The company certainly has a lot going against it, as digital downloads are becoming more popular and the threat of the game console makers disallowing used games puts GameStop Corp. (NYSE:GME)’s business in jeopardy. But is the company in danger of going bankrupt anytime soon? Here is the z-score calculation.

All values in millions

Gamestop’s z-score has been surprisingly steady over the past five years, staying in the high 3’s most of the time. This value is well within the “safe zone” and leads to the conclusion that GameStop Corp. (NYSE:GME) is in no danger of going bankrupt in the next few years. This says nothing about its prospects ten years out, as there are definitely real threats to its business model, but today the company is in good shape financially.

EBIT turned negative in 2012, but this is largely due to a large $681 million asset impairment. Excluding this item net income only fell slightly from the prior year’s adjusted value, so the company is actually in even better shape than the numbers above suggest. Another positive is a new game console generation arriving this fall, with Sony and Microsoft set to release new consoles. This should provide a boost to Gamestop’s top line as interest in video games grows.

It’s hard to say what GameStop Corp. (NYSE:GME)’s long-term prospects are, but the company is financially sound and is in no danger of bankruptcy.

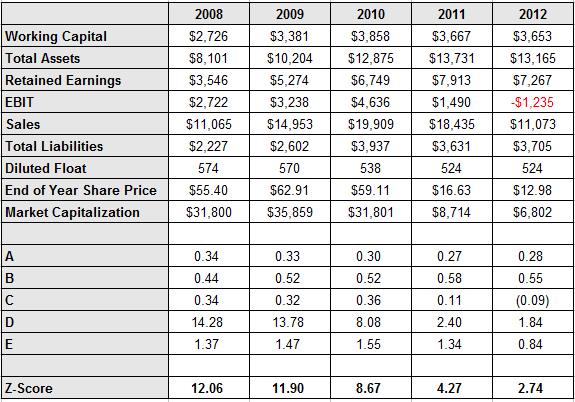

BlackBerry

BlackBerry, once called Research in Motion, used to be the dominant provider of smart phones. From 2003 to 2010 revenue grew at an annualized rate of 65%, topping out at $19.9 billion. Net income in that year was $3.4 billion. But Research In Motion Ltd (NASDAQ:BBRY) couldn’t keep up with the likes of the iPhone and Android, and sales plummeted back to just $11 billion in 2012 as net income turned resoundingly negative. How likely is Research In Motion Ltd (NASDAQ:BBRY) to go bankrupt in the next few years? Here’s the z-score calculation.

All values in millions

In its heyday BlackBerry’s z-score was high enough to be irrelevant. But by 2012 the z-score had fallen to 2.74, which is in the “grey zone.” What does this mean? Well, Research In Motion Ltd (NASDAQ:BBRY) isn’t in any immediate threat of bankruptcy, but the situation is getting worse. The company has no debt, so it would take a few years of big losses before it would have to turn to debt to finance operations.