Investment management company First Pacific Advisors recently released its “FPA Queens Road Small Cap Value Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. In the second quarter, the fund returned 8.60% compared to a 4.97% return for the Russell 2000 Value Index. Moreover, the Fund returned 5.87% YTD, compared to -3.16% for the index. Additionally, you can check the fund’s top 5 holdings to determine its best picks for 2025.

In its second-quarter 2025 investor letter, FPA Queens Road Small Cap Value Fund highlighted stocks such as Vishay Intertechnology, Inc. (NYSE:VSH). Vishay Intertechnology, Inc. (NYSE:VSH) is a technology company that manufactures and sells discrete semiconductors and passive electronic components. The one-month return of Vishay Intertechnology, Inc. (NYSE:VSH) was -15.75%, and its shares lost 26.57% of their value over the last 52 weeks. On August 18, 2025, Vishay Intertechnology, Inc. (NYSE:VSH) stock closed at $14.76 per share, with a market capitalization of $2.001 billion.

FPA Queens Road Small Cap Value Fund stated the following regarding Vishay Intertechnology, Inc. (NYSE:VSH) in its second quarter 2025 investor letter:

“Vishay Intertechnology, Inc. (NYSE:VSH) makes passive electronic components and discrete semiconductors (resistors, inductors, capacitors, MOSFETs, diodes, etc.). Although the industry is cyclical, competitive dynamics are stable and VSH benefits from incremental growth in electric vehicles and industrial electrification. The industry is currently struggling from a cyclical downturn following the excesses and component hoarding of the Covid era. Additionally, at its April 2024 Investor Day, Vishay announced very aggressive 2028 investment and profitability targets with a plan to strategically change the company’s culture that was notably staid and overly-conservative.14 We are cautiously optimistic about Vishay’s growth plans and have been adding to the position during this cyclical weakness.”

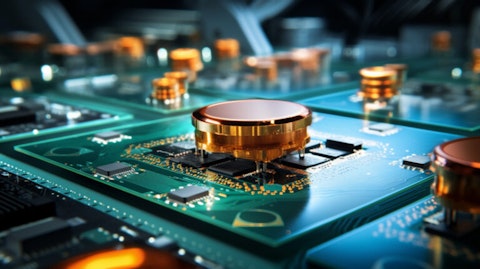

A close-up of discrete semiconductors in a manufacturing lab.

Vishay Intertechnology, Inc. (NYSE:VSH) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 29 hedge fund portfolios held Vishay Intertechnology, Inc. (NYSE:VSH) at the end of the first quarter, which was 31 in the previous quarter. Vishay Intertechnology, Inc.’s (NYSE:VSH) Q2 2025 revenue grew sequentially 7% to $762 million. While we acknowledge the risk and potential of Vishay Intertechnology, Inc. (NYSE:VSH) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Vishay Intertechnology, Inc. (NYSE:VSH) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Vishay Intertechnology, Inc. (NYSE:VSH) and shared the list of best semiconductor stocks to buy under $20. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.