After gathering more than $1 trillion in total assets under management, ETFs have cemented their placein the financial world. Among the universe of nearly 1,500 products, commodity funds have garnered a lot of attention, as these products have democratized an asset class that was once difficult to reach by retail investors. Now, there are a number of exchange-traded options to help you gain exposure to your favorite hard assets, all at a low cost.

Even among ETFs, however, there can be significant differentials in fees. It’s not uncommon for two products with similar portfolios and investment objectives to sport extreme differences in expense ratios. In other words, don’t assume that all ETFs arecost efficient. Sorting through the exchange-traded options can be a valuable exercise for those looking to cut down on fees. Below, we outline the cheapest ETFs for every major commodity and the results may surprise you [for more commodity ETF news and analysis subscribe to our free newsletter].

Note that commodities that have just one ETF are depicted with an asterisk, leaving plenty of room for competition from hopeful issuers.

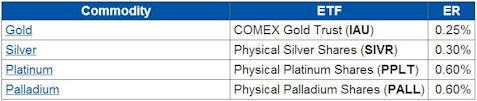

Precious Metals

With plenty of competition in the gold and silver space, it should not come as a major surprise to see both SPDR Gold Trust (NYSEARCA:GLD) and iShares Silver Trust (NYSEARCA:SLV) miss the list, as both iShares Gold Trust (NYSEARCA:IAU) and Silver Trust (NYSEARCA:SIVR) offer near-identical exposure for lower expenses. The remaining two metals ETFs come from only a short list with little else to choose from, still leaving room for new entrants [see also Which Gold ETF Is Right For You? GLD vs. IAU vs. SGOL].

Energy

A very clear domination by US Commodity Funds, the issuer behind all of the cheapest energy ETFs. The good news is that there is still plenty of room for newcomers to offer similar funds at lower expenses, as some of the products above are the only ETFs for their respective commodity.

Agriculture

The soft commodities are stuck in a deadlock as far as expenses are concerned. Given that iPath has stuggled with their Pure Beta line, it may be the case that they try slashing expense ratios to gain a leg up on the competition in the near future. Teucrium also holds a monopoly on a number of agricultural products, but with Teucrium Corn Fund (NYSEARCA:CORN) being such a successful product, it is only a matter of time before someone else comes along with a less expensive fund [see also Jim Rogers: The Agriculture Industry is Doomed].

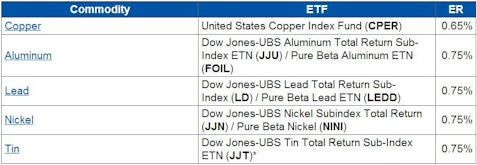

Industrial Metals

Another group of commodities with not a lot of products to go around. It simply goes to show you that the commodity ETF space still has a lot of growth potential left and room for plenty of new innovation, especially on the cost front.

Alternative Energy

Last but not least the alternative energy world has gotten some fair representation from ETFs. Unfortunately the poor performance of the industry overall has been tough on these funds, as many have begun to wonder whether widespread adoption of these resources will happen in our lifetimes.

This article was originally written by Jared Cummans, and posted on CommodityHQ.