Earnings Review

Group revenues fell slightly (-3% YoY) to S$18.183 billion ($14.55 billion USD) for the quarter ending March 31, 2013. While the Group’s FY13 operational EBITDA margin grew for the first time in eight years, to 28.6% (29.3% ex-digital business), net profit after tax fell 33% YoY to S$868 million ($694.4 million USD) as foreign exchange fluctuations, spectrum investment and digital initiatives in FY13 cut into the bottom line. The S$0.10 per share final dividend was higher than expectations, pushing FY2012 total payouts to S$0.168 per share, implying a 74% payout of free cash flow, compared to S$0.158 per share in FY2012, a 69% payout. This works out to a current yield of 4.5%, which is attractive compared to the Singapore market as well as regional telcos. OCBC cut its rating on the sector to neutral from overweight on May 21, and Singapore Telecom (NASDAQOTH:SGAPY.PK)’s shares declined 2% on the news. It has corrected recently off its highs.

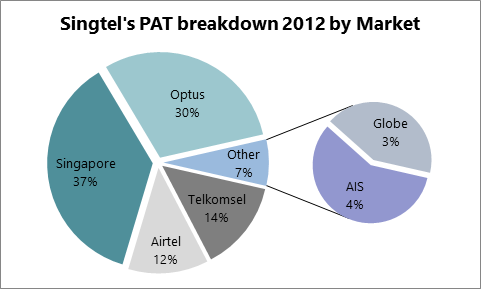

The Group leveraged its combined procurement, network and IT capabilities across geographies, delivering impressive efficiencies, and its investments in regional carriers across Southeast Asia are where much of the company’s earnings came from. Earnings from Indonesia’s Telkomsel (SingTel has a 35% stake), Thailand’s Advanced Info Services (a 23.32% stake) and the Philippines Globe Telecom (a 44% stake) saved Singapore Telecom (NASDAQOTH:SGAPY.PK)’s earnings this year due to growth in both subscribers and mobile data.

Among these investments, Telkomsel had the largest contribution to the Group’s profit after tax — 14% of the total. Meanwhile, AIS’s contributions were further bolstered by the Thai baht’s 2% against the Singapore dollar and lower corporate taxes. AIS is a stock that I have been high on for a while (see here and here). However, India’s Bharti Airtel (a 32.25% stake) continues to be a drag due to higher depreciation and amortization in Africa and the 11% depreciation of the Indian rupee against the SingDollar.

New Models Emerging

In Singapore, despite significant industry challenges from competitors, Singapore Telecom (NASDAQOTH:SGAPY.PK) still manages to remain a robust foundation for continued profitability. Starhub and M1 are both much smaller in terms of scale, market cap and subscribers. And while overall revenue growth has been difficult, post-paid mobile subscriptions rose overall for all three carriers — SingTel (+1.4%), M1 (+1.1%) and Starhub (+0.8%) — but it is the rise of over the top services such as Facebook Inc (NASDAQ:FB), Google Inc (NASDAQ:GOOG), WeChat and Whatsapp.

Nokia Corporation (ADR) (NYSE:NOK)’s bundling of Facebook Inc (NASDAQ:FB) with their Asha phones in India and other emerging markets will help to sell data packages in the long run as it introduces feature phone customers to what is possible with a low-end smartphone. This is an enormous development that will help drive the conversion of customers from minute plans to data packages. The result will be very good for both Nokia and Facebook in the short term, but the effect for the carriers will be felt in the longer term as the conversion rate will take time. Package minutes are a dying business model outside of emerging markets with only 2G service.

The impact of this will be felt more so in emerging markets than in developed ones; as carriers move into new areas new opportunities are presenting themselves, and the challenge for all carriers is to simply not become a dumb wireless network but rather a true value-added service. To that end, SingTel plans to spend $1.6 billion in three years to acquire companies specializing in digital advertising, content and entertainment. As markets like Thailand build out their 3G and LTE networks, there will be a higher percentage of customers ready to make the switch up to an entry-level smartphone. For Nokia Corporation (ADR) (NYSE:NOK), that means selling low-end Lumias running Windows Phone. For Facebook that means more mobile ad and game revenue.