In February this year, Exelon Corporation (EXC) cut its dividend by 41%. In July, Walter Energy Inc. (WLT) stock tumbled after a 92% dividend cut. We used the Dividend Cut Screen on our platform to look for other companies that might slash their dividends in the short term. Our Dividend Cut Screen filters companies that might have to decrease their dividends due to relatively weak operating results, pressure on interest coverage and an already low quality dividend because of a weak cash cushion (for the dividend). We selected 5 screener results — all companies from the energy and utilities sector that are in a bit of a spot right now. If their operating results continue to remain weak, we think they might be compelled to cut their dividends.

Are First Energy’s returns sustainable? Is the company operationally challenged? Find out with this report.

Dividend Cut Screen: Selected Results

FirstEnergy Corp. (NYSE:FE) is a diversified energy company through its subsidiaries and affiliates is engaged in the generation, transmission and distribution of electricity, as well as energy management and other energy-related services. Industry Group: Electric Utilities

Regency Energy Partners LP (NYSE:RGP) is engaged in the gathering and processing, compression, treating and transportation of natural gas and the transportation, fractionation and storage of natural gas liquids (NGL). Industry Group: Oil Refining/Marketing

Linn Energy LLC (NASDAQ:LINE) is an independent oil and natural gas company focused on the development, exploitation and acquisition of natural gas. Industry Group: Oil & Gas Production

Targa Resources Corp (NYSE:TRGP) provides midstream natural gas, natural gas liquid terminaling, and crude oil gathering services in the United States. Industry Group: Oil Refining/Marketing

Pepco Holdings, Inc. (NYSE:POM) is a holding company through the subsidiaries, is engaged in the transmission, distribution and default supply of electricity and, to a lesser extent, the distribution and supply of natural gas. Industry Group: Electric Utilities

Focus Stock: FirstEnergy Corp. (NYSE:FE)

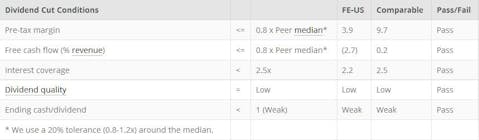

To check for a dividend cut at FE, we look for underperformance relative to its peers (see peer list at the end of this post) in terms of both pre-tax margins and operating cash flow. In addition, we checked if the interest coverage that is tight. These factors, when combined with an existing low quality dividend and a weak cash cushion would suggest that a dividend cut is likely.

Fundamentals justify a dividend cut in the short-term

FE’s relatively weak operating results and a low interest coverage combined with a low quality dividend could eventually imply downward pressure on dividends. This situation is exacerbated by a weak cash cushion (just 0.3x the cash dividend), which justifies a dividend cut in the short-term.

Peers used for analysis of FirstEnergy Corp. (NYSE:FE):

The Southern Company (NYSE:SO), NextEra Energy, Inc. (NYSE:NEE), Exelon Corporation (NYSE:EXC), American Electric Power Company, Inc. (NYSE:AEP), PPL Corporation (NYSE:PPL), Consolidated Edison, Inc. (NYSE:ED), Public Service Enterprise Group Inc. (NYSE:PEG) and Pepco Holdings, Inc. (NYSE:POM).

Are First Energy’s returns sustainable? Is the company operationally challenged? Read this report to find out!

This article was first published on the CapitalCube Blog; disclaimer.