The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards FedEx Corporation (NYSE:FDX).

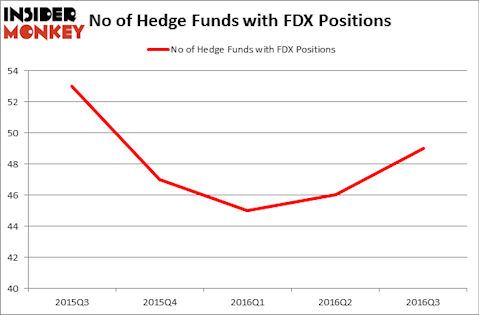

Is FedEx Corporation (NYSE:FDX) a splendid investment right now? Hedge funds are taking an optimistic view. The number of long hedge fund positions inched up by 3 in recent months. FDX was in 49 hedge funds’ portfolios at the end of the third quarter of 2016. There were 46 hedge funds in our database with FDX holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as PNC Financial Services (NYSE:PNC), America Movil SAB de CV (ADR) (NYSE:AMX), and Raytheon Company (NYSE:RTN) to gather more data points.

Follow Fedex Corp (NYSE:FDX)

Follow Fedex Corp (NYSE:FDX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

pio3 / Shutterstock.com

How have hedgies been trading FedEx Corporation (NYSE:FDX)?

At Q3’s end, a total of 49 of the hedge funds tracked by Insider Monkey held long positions in this stock, an uptick of 7% from the previous quarter. After bottoming out during the first quarter of 2016, hedge fund sentiment has begun to rebound, increasing by 10%. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Mason Hawkins’ Southeastern Asset Management has the largest position in FedEx Corporation (NYSE:FDX), worth close to $1.15 billion, amounting to 11.1% of its total 13F portfolio. Sitting at the No. 2 spot is Greenhaven Associates, led by Edgar Wachenheim, holding a $787.4 million position; 15% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish comprise Michael Larson’s Bill & Melinda Gates Foundation Trust, John Smith Clark’s Southpoint Capital Advisors, and Israel Englander’s Millennium Management.

With general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, established the largest position in FedEx Corporation (NYSE:FDX). Renaissance Technologies had $141.7 million invested in the holding at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $79.3 million position during the third quarter. The following funds were also among the new FDX investors: Alexander Mitchell’s Scopus Asset Management, Ken Heebner’s Capital Growth Management, and Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital.

Let’s also examine hedge fund activity in other stocks similar to FedEx Corporation (NYSE:FDX). We will take a look at PNC Financial Services (NYSE:PNC), America Movil SAB de CV (ADR) (NYSE:AMX), Raytheon Company (NYSE:RTN), and Northrop Grumman Corporation (NYSE:NOC). This group of stocks’ market caps are similar to FDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNC | 51 | 1891503 | 6 |

| AMX | 11 | 268831 | -2 |

| RTN | 36 | 1038218 | -2 |

| NOC | 37 | 1229934 | -7 |

As you can see these stocks had an average of 33.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.11 billion. That figure was $4.03 billion in FDX’s case. PNC Financial Services (NYSE:PNC) is the most popular stock in this table. On the other hand America Movil SAB de CV (ADR) (NYSE:AMX) is the least popular one with only 11 bullish hedge fund positions. FedEx Corporation (NYSE:FDX) is not the most popular stock in this group but hedge fund interest is still above average and it has more than double the amount of money invested in it than any of the other stocks. This is a positive signal when coupled with the rising sentiment, so now may be a good time to consider going long FedEx.

Disclosure: None