Facebook earnings

Facebook Inc (NASDAQ:FB) reported a solid quarter, and I have to admit I was a little wary of the company. But, finally Mark Zuckerberg has been able to revive hopes in his company. In an earlier article, I mentioned that advertising in user news feeds should give a boost to mobile revenue that could lead to a beat on expectations.

Lo’ and behold, the company’s mobility segment was the primary contributor to the company’s success in the past quarter. The company reported revenue that was up by 53% year-over-year in the second quarter. It also reported gross margins of 31%, which were up sharply from the -63% gross margin in the previous year.

The company was then able to report non-GAAP (generally accepted accounting principles) earnings per share of $488 million in the most recent quarter. Not only that! The company managed to lower its expenses by $676 million year-over-year. In a previous article, I mentioned that the company could generate higher returns just by managing costs better. Facebook was able to grow net income by 375% year-over-year.

It reported non-GAAP earnings per share of $0.19 for the quarter. Analysts on a consensus basis were anticipating the company to report earnings of $0.14 for the previous quarter. The company beat earnings expectations by 28.5%. At the time of writing, the stock is up by 16.9% in after-hours trading.

Summary and outward-looking analysis

It seems that just a modest shift in product and strategy could have a very significant impact on earnings in the Internet space. Going forward, analysts are going to maintain a buy rating on other web companies under the basis that web properties may generate higher rates of growth by adjusting their strategies to smartphone devices.

Source: Facebook

Source: FacebookWhat’s nice about Facebook Inc (NASDAQ:FB) is that it really doesn’t have to choose sides when it comes to smartphones. The fact is any smartphone can run Facebook, which is another contributing factor to its success. Outward-looking forecasts from IDC indicate that smartphone shipments will grow at a compound annual growth rate of 18.6% until 2016.

Source: Facebook

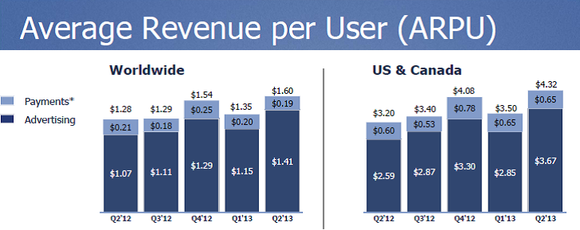

Source: FacebookNot so surprisingly, the largest market for mobile advertising is North America, so by focusing on the 41% year-over-year, revenue-per-user growth in the US and Canada segment, we can get a basic idea of how mobile revenue impacted consolidated revenue results for the past quarter. Another contributor to mobile growth was the 60% year-over-year gain in daily users. The total increase in users paired with the growth in monetization from each user contributed to the company’s earnings beat this past quarter.

Google’s not-so-hot quarter

Software and services seem to be the hot spot in technology. I have to admit that I am not exactly happy with Google Inc (NASDAQ:GOOG)’s results. The company did mention that it was focusing on incremental revenue gains in the first quarter. So going into the second quarter, it has been largely understood that profitability may actually fall below expectations.

Another difficulty Google Inc (NASDAQ:GOOG) faced that Facebook Inc (NASDAQ:FB) did not was that pricing for display- based ads were down by around 6% year-over-year. The decline in pricing (most likely) came from the falling conversion rates from people who click through ads on mobile devices. After all, purchasing a product or service through a mobile advertisement can be difficult, and the quality of the buying experience isn’t exactly hot. The placement of ads on a mobile screen is also difficult. This is why Google’s AdSense business seems to be fine, but banner advertising –not so much.