Facebook Inc (NASDAQ:FB) was the most anticipated IPO stock of 2012, pricing at $38 per share, above expectations. The first day of trading was marred with technical glitches, and underwriters wound up having to buy shares throughout the day to support the IPO price. It immediately began dropping due to worries about their ability to monetize mobile ads among other things, causing shares to trade as low as $17.55 in the following months. Earlier this year it looked like it was starting to gain traction, trading at around the $30 level on optimism surrounding the monetization of mobile ads.

Lately the market has not been so kind. Since early February, shares have dropped over 16%. What happened? While I agree that the future of Facebook Inc (NASDAQ:FB) is far from certain, at some point this company’s growth prospects relative to the share price will be too cheap to ignore. I think that time is right now.

What a Growth Story!

Facebook is by far the world’s largest social media company, and the statistics surrounding the company seem to get more and more impressive, especially considering how young the company is. Last September, for instance, Facebook topped 1 billion monthly average users, a huge milestone. As of January 2013, Facebook Inc (NASDAQ:FB) users had shared 240 billion pictures and had established over 1 trillion connections.

Facebook’s basic strategy is to remain the best in its business by developing technologies that are so engaging and compelling that people simply cannot live without a Facebook page, a strategy that has been successful so far. How many of you have tried to “quit” Facebook for a few months in order to increase the level of productivity in other areas of your life. Most people would find this as difficult as quitting smoking! Facebook Inc (NASDAQ:FB) also hopes to continue expanding its global reach into underpenetrated areas, such as Brazil, India, Russia, and Japan.

A Few “Negatives”, if You See Them That Way

Although Facebook has been one of the most impressive growth stories of all time, the company has a few negatives. First, Mark Zuckerberg essentially has absolute power in terms of decision-making in the company, with 55% of the voting shares. How much of a negative this is depends on your personal opinion and faith in Zuckerberg.

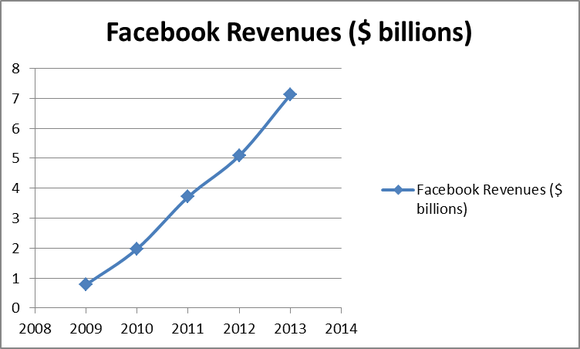

More importantly, Facebook has a very limited history as a company, and an even more limited history as a profitable one. Because of this, the market is very uncertain of Facebook’s ability to create significant, sustained profitability. However, as I have said before, some of the market’s best opportunities are created by uncertainty. What I am certain of is that Facebook Inc (NASDAQ:FB) seems to be figuring out the whole monetization challenge fast enough, as evidenced by the revenue chart below. What stands out to me is the almost perfectly linear rise. Revenues are projected to be over $7 billion this year, and growth has not slowed down yet!

Facebook’s revenues are largely dependent on advertising revenues, which account for over 80% of the company’s cash flow. The rest comes from payments collected from partner sites, such as Zynga Inc (NASDAQ:ZNGA), which accounts for 15% or so of Facebook’s revenues with its games such as Farmville.

Zynga

Speaking of Zynga, let’s take a quick look at this company, which has plunged from its IPO price of $10 to the current level of around $3. A lot of investors question the long-term profitability of Zynga, but I’m not so sure. Zynga Inc (NASDAQ:ZNGA) has taken steps to cut its expenses and also plans to expand its business to areas like online gambling and licensed board games. With a market cap of just $2.5 billion, Zynga needs to just get a little more efficient in its operations. The revenues are definitely there, at almost $1.3 billion in 2012. They just need to figure out how to get some profit out of their existing revenues stream and this could move sharply to the upside.

Valuation and Growth

At 44.5 times forward earnings, a traditional P/E analysis isn’t too effective here. Consensus estimates call for a 40% average annual earnings growth rate for the next three years, so I prefer to think of Facebook Inc (NASDAQ:FB)’s valuation as 16.5 times 2016’s earnings, which puts things in a much clearer perspective. Also, with $8 billion in net cash already, I would imagine this stockpile will increase with the company’s earnings going forward.

Alternatives in Social Networking

The other major publicly traded social networking company is LinkedIn Corp (NYSE:LNKD), which unlike Facebook, has been on a tear the last few months, and is now sitting at an all-time high. Although the company is barely profitable at this point, earnings are expected to grow nicely over the next few years; however the company still trades at a premium to Facebook at 58 times the projected earnings of three years from now. Facebook Inc (NASDAQ:FB) has built up a better cash position, and has done a better job of turning its revenue growth into earnings, which were 53 cents per share last year, as opposed to just 19 cents per share for LinkedIn, despite the fact that LinkedIn trades for about 7 times the share price of Facebook.

Conclusion

My personal opinion is that LinkedIn Corp (NYSE:LNKD) is far too speculative and that Facebook has a much higher probability of success in the long run due to the mass appeal of its product. If the company can deliver on the projections, the current price looks like a very good entry point indeed.

The article Facebook: Fad or Bargain? originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.