Many people have heard about the “shale revolution” in oil production. However, from a practical perspective, it has been easy to miss. Despite the growing flow of oil from North Dakota, Texas, and other parts of the U.S. (and Canada), oil prices have remained stubbornly high.

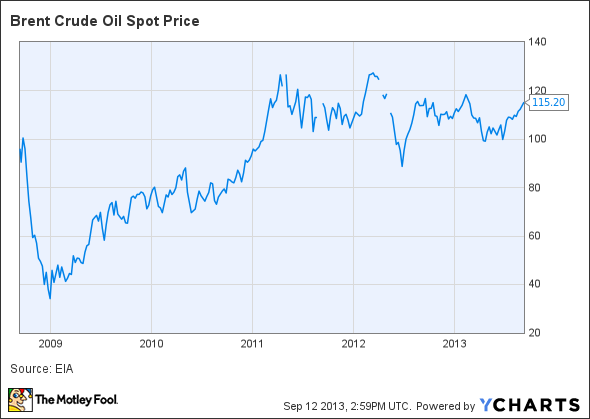

Brent Crude Oil Spot Price, data by YCharts

In fact, Brent crude — arguably the most important international oil benchmark — has remained within a trading range of $100 to $120 a barrel since the beginning of 2011, except for a few brief periods. However, that may be about to change. U.S. oil production has been surging higher for the past two years and is on pace to hit record highs as early as the end of 2015.

This rapid growth in production is dramatically reducing the country’s reliance on oil imports — something that will be especially evident in the coming months, as the peak summer driving season recently ended. Eventually, this trend is likely to lead to lower oil prices.

Peak oil: not here yet

As recently as 2007, many informed observers believed that U.S. crude oil production had entered an inexorable period of decline. Considering that declining production had been a constant trend for more than 20 years by that point, this opinion was pretty understandable.

U.S. crude oil production, 1949-2008 (Source: EIA).

However, rising oil prices made alternative production methods economical soon thereafter. The sustained period of $100 oil since 2011 has allowed shale explorers such as EOG Resources Inc (NYSE:EOG) and Continental Resources, Inc. (NYSE:CLR) to rapidly and profitably expand output.

U.S. headed for self-sufficiency

The success of so many shale projects is pushing the U.S. closer to self-sufficiency for oil. Last week, U.S. oil production rose to 7.75 million bpd, according to the EIA. That’s the highest level since 1989! U.S. production was just 7 million bpd at the beginning of this year, and 5.64 million bpd two years ago.

U.S. oil production has risen steady since mid-2011. (Source: EIA.)

We’re still very far from the domestic production record of nearly 10 million bpd set in 1970. That said, if production continues to grow at the recent pace of roughly 1 million bpd per year, U.S. oil production will surpass that level in late 2015.

The result is that U.S. net imports of crude oil and petroleum products are falling. Net imports totaled 6.28 million bpd last week. Moreover, petroleum product stockpiles increased last week because of seasonally lower demand. The U.S. would have needed less than 6 million bpd of net imports to meet demand. By contrast, net imports averaged 9.71 million bpd in 2010!

Foolish bottom line

The surge in U.S. oil production over the past two to three years has put the U.S. well on the road to energy self-sufficiency, though there is still plenty of work left to be done. The reduction of U.S. demand for oil imports should lead to lower oil prices over time. (Indeed, Brent crude futures prices imply that the market expects oil prices to drop by roughly $10 a barrel over the next year.)

Even if U.S. production continues growing, there is no guarantee that lower oil prices will result. This year, geopolitical turmoil has kept prices elevated. Tensions related to Iran’s nuclear program and the ongoing civil conflict in Syria have raised risk perceptions globally. Meanwhile, unrest in Libya and Iraq have led to production declines in both countries recently.

However, as long as conditions in the Middle East and North Africa don’t get worse — and especially if they get better — the shale revolution in North America may be on the verge of finally reining in world oil prices. Consumers will undoubtedly rejoice if that happens.

The article U.S. Oil Production Soars Toward Historic Highs originally appeared on Fool.com.

Fool contributor Adam Levine-Weinberg and The Motley Fool have no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.