The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 873 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 30th, 2021. What do these smart investors think about Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN)?

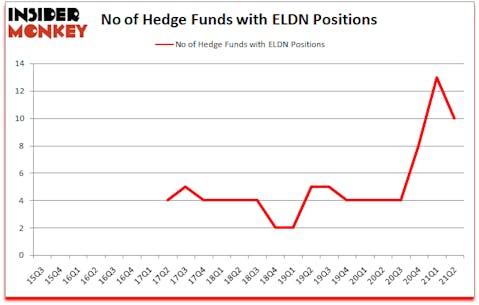

Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN) investors should pay attention to a decrease in hedge fund sentiment recently. Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN) was in 10 hedge funds’ portfolios at the end of June. The all time high for this statistic is 13. There were 13 hedge funds in our database with ELDN positions at the end of the first quarter. Our calculations also showed that ELDN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most traders, hedge funds are assumed to be worthless, outdated investment tools of years past. While there are over 8000 funds with their doors open at present, We look at the upper echelon of this club, about 850 funds. These hedge fund managers command most of all hedge funds’ total asset base, and by paying attention to their highest performing stock picks, Insider Monkey has spotted numerous investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

Phillip Gross of Adage Capital

Now let’s analyze the recent hedge fund action surrounding Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN).

Do Hedge Funds Think ELDN Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards ELDN over the last 24 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Cormorant Asset Management held the most valuable stake in Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN), which was worth $11.2 million at the end of the second quarter. On the second spot was Biotechnology Value Fund / BVF Inc which amassed $8.8 million worth of shares. Woodline Partners, Adage Capital Management, and Ikarian Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cormorant Asset Management allocated the biggest weight to Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN), around 0.38% of its 13F portfolio. Biotechnology Value Fund / BVF Inc is also relatively very bullish on the stock, dishing out 0.33 percent of its 13F equity portfolio to ELDN.

Judging by the fact that Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN) has faced a decline in interest from hedge fund managers, it’s safe to say that there is a sect of hedgies that slashed their positions entirely last quarter. At the top of the heap, Oleg Nodelman’s EcoR1 Capital cut the largest position of the “upper crust” of funds followed by Insider Monkey, comprising about $11.9 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its stock, about $0.3 million worth. These transactions are interesting, as total hedge fund interest was cut by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN) but similarly valued. We will take a look at PHX Minerals Inc. (NYSE:PHX), Aileron Therapeutics, Inc. (NASDAQ:ALRN), Vivos Therapeutics, Inc. (NASDAQ:VVOS), IsoRay, Inc. (NYSE:ISR), Phoenix New Media Ltd (NYSE:FENG), Scopus BioPharma Inc. (NASDAQ:SCPS), and Orgenesis Inc. (NASDAQ:ORGS). This group of stocks’ market caps match ELDN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHX | 7 | 10945 | 2 |

| ALRN | 8 | 11840 | 2 |

| VVOS | 4 | 2947 | 1 |

| ISR | 2 | 2100 | -2 |

| FENG | 4 | 1585 | -1 |

| SCPS | 1 | 115 | -1 |

| ORGS | 4 | 1540 | 1 |

| Average | 4.3 | 4439 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.3 hedge funds with bullish positions and the average amount invested in these stocks was $4 million. That figure was $40 million in ELDN’s case. Aileron Therapeutics, Inc. (NASDAQ:ALRN) is the most popular stock in this table. On the other hand Scopus BioPharma Inc. (NASDAQ:SCPS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Eledon Pharmaceuticals, Inc. (NASDAQ:ELDN) is more popular among hedge funds. Our overall hedge fund sentiment score for ELDN is 75.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.7% in 2021 through September 27th and still beat the market by 6.2 percentage points. Unfortunately ELDN wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ELDN were disappointed as the stock returned -19% since the end of the second quarter (through 9/27) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Eledon Pharmaceuticals Inc. (NASDAQ:ELDN)

Follow Eledon Pharmaceuticals Inc. (NASDAQ:ELDN)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Data Stocks to Buy Now

- 10 Best Tech ETFs to Buy According to Reddit

- 10 Best SPACs to Buy According to SoftBank’s Masayoshi Son

Disclosure: None. This article was originally published at Insider Monkey.