CEO Resignation

John Riccitiello announced his resignation on Monday, after having headed the company since 2007. The news was cheered by investors, who sent the stock up over $20 in after-hours trading. The news comes amid reports of slowing sales across the gaming industry, which is trying to reinvent itself and embrace changing technologies and consumer preferences. Riccitiello has taken full responsibility for Electronic Arts Inc. (NASDAQ:EA)’s disappointing performance recently, stating the following in a blog post: “My decision to leave EA is really all about my accountability for the shortcomings in our financial results this year.” Chairman Larry Probst will be leading the company during the search for a new CEO.

The catalyst, or perhaps the final straw, leading to the decision involved the fiscal 2013 sales forecast and the current Q4 results. Versus a projected 4.3 billion sales figure, the company now expects sales of $3.78 billion or less. Regarding Q4, the company warned yesterday that its results may fall short of the previously issued and already lowered forecast of earnings between $0.57 and $0.72. According to Bloomberg data, Electronic Arts Inc. (NASDAQ:EA) posted net losses excluding items in four of the five past fiscal years. Lately, the company has been plagued by a series of badly executed moves, including the fumbled SimCity release, and poor reviews for its latest edition of the Medal of Honor series.

Paradigm Shift

The challenge that gaming companies now face is to make the switch from packaged games, which have traditionally accounted for the bulk of sales, to online content, which can be downloaded on tablets and mobile phones. Another trend is the switch towards a more social form of gaming, which Activision Blizzard, Inc. (NASDAQ:ATVI) has been able to capitalize on with its wildly popular and severely addictive World of Warcraft game–although the company is facing the same problems as Electronic Arts Inc. (NASDAQ:EA) in terms of users switching to free online content.

EA has made some pretty good progress in growing its mobile segment, investing over a billion dollars in this fast growing market. According to analysts, mobile revenue was a rare bright spot in the company’s recent reports. Another possible boost for sales could be the introduction of new consoles such as Sony’s new PlayStation, which is scheduled for release before the end of the year. However, the crucial issue will be how well EA adapts to the shifting technological environment.

Valuations and Metrics

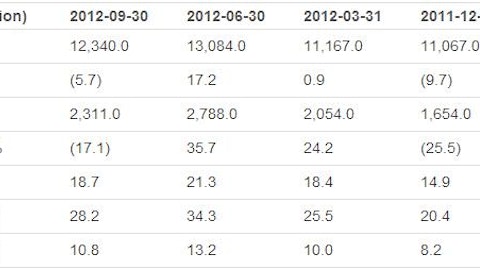

According to Yahoo!, Electronic Arts Inc. (NASDAQ:EA) is trading at a TTM P/E of 34.2x, far above Activision Blizzard’s quite reasonable 14.23x. Looking at price to sales, EA is substantially cheaper, with 1.42 versus Activision’s 3.3. EA’s forward P/E is a little better at 16.41, but still well over the industry average. The company’s operating margin is a fairly tight 4% and the return on equity is about 8.3%. On the other hand, the company’s balance sheet is fairly strong with about $1.5 billion in cash and just over $550 million in debt.

Bottom Line

The resignation of Electronic Arts’ CEO highlights the difficulties currently facing the traditional gaming industry. With declining sales, it is a struggle for these companies to make the transition to a new way of creating and distributing content. However, Electronic Arts Inc. (NASDAQ:EA) appears committed to pumping money into this segment, and may get a boost from new consoles scheduled to be released soon. It remains to be seen how EA’s management will cope with this situation under new leadership.

The article Electronic Arts CEO Steps Down, What’s Next? originally appeared on Fool.com and is written by Daniel James.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.