Amphenol Corp. Cl A’s analysis versus peers uses the following peer-set: TE Connectivity Ltd. (NYSE:TEL), Molex Incorporated (NASDAQ:MOLX), HIROSE ELECTRIC CO., LTD. (TYO:6806), Belden Inc. (NYSE:BDC), AVX Corporation (NYSE:AVX) and Methode Electronics Inc. (NYSE:MEI). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

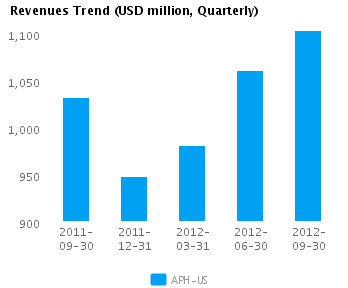

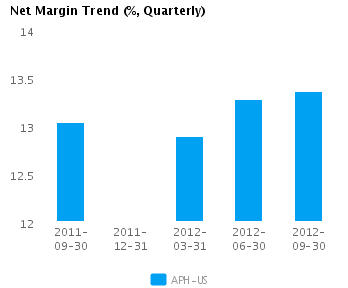

| Quarterly (USD million) | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 |

|---|---|---|---|---|---|

| Revenues | 1,103.4 | 1,061.1 | 981.6 | 948.7 | 1,032.8 |

| Revenue Growth % | 4.0 | 8.1 | 3.5 | (8.1) | 1.5 |

| Net Income | 147.5 | 140.9 | 126.6 | 113.9 | 134.6 |

| Net Income Growth % | 4.6 | 11.4 | 11.2 | (15.4) | (8.9) |

| Net Margin % | 13.4 | 13.3 | 12.9 | 12.0 | 13.0 |

| ROE % (Annualized) | 25.2 | 25.0 | 19.8 | 20.8 | 23.9 |

| ROA % (Annualized) | 12.0 | 12.1 | 11.2 | 10.3 | 12.4 |

Valuation Drivers

Amphenol Corp. Cl A’s current Price/Book of 4.1 is about median in its peer group. APH-US’s operating performance is higher than the median of its chosen peers (ROE of 22.8% compared to the peer median ROE of 11.7%) but the market does not seem to expect higher growth relative to peers (PE of 19.7 compared to peer median of 18.3) but simply to maintain its relatively high rates of return.

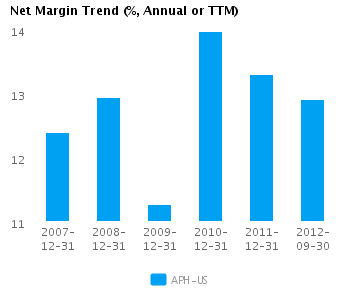

The company attempts to achieve high profit margins (currently 12.9% vs. peer median of 7.9%) through differentiated products. It currently operates with peer median asset turns of 0.9x. APH-US’s net margin continues to trend downward and is now similar to its five-year average net margin of 12.8%.

Economic Moat

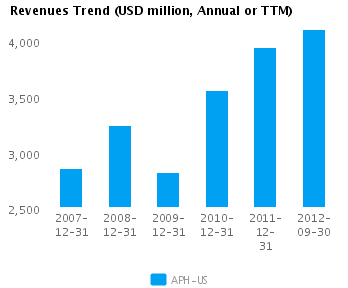

The company’s year-on-year change in revenue of 10.9% is better than the peer median but it has not resulted in the same quality of annual earnings growth (5.6% compared to the peer median of 5.6%). This suggests that APH-US’s current relative cost structure needs to improve to move to a leading position among its peers. APH-US is currently converting every 1% of change in revenue into 0.5% change in annual reported earnings.

APH-US’s return on assets is above its peer median both in the current period (11.2% vs. peer median 6.0%) and also over the past five years (13.1% vs. peer median 3.1%). This performance suggests that the company’s relatively high operating returns are sustainable.

The company’s gross margin of 34.3% is around peer median suggesting that APH-US’s operations do not benefit from any differentiating pricing advantage. However, APH-US’s pre-tax margin is more than the peer median (17.7% compared to 10.7%) suggesting relatively tight control on operating costs.

Growth & Investment Strategy

While APH-US’s revenues have grown faster than the peer median (6.8% vs. 3.0% respectively for the past three years), the market gives the stock an about peer median PE ratio of 19.7. This suggests that the market has some questions about the company’s long-term strategy.

APH-US’s annualized rate of change in capital of 18.4% over the past three years is higher than its peer median of 5.2%. This investment has generated an above peer median return on capital of 15.7% averaged over the same three years. Evidently, the relatively high capital investment was successful given the relatively strong growth in its returns.

Earnings Quality

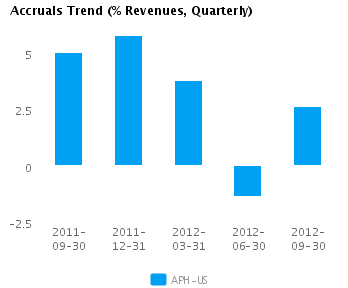

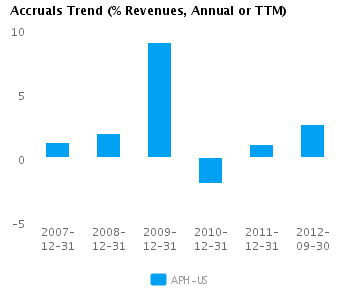

APH-US has reported relatively strong net income margin for the last twelve months (12.9% vs. peer median of 7.9%). This strong margin performance was accompanied by a level of accruals that was around peer median (2.6% vs. peer median of 3.1%) suggesting that the reported net income is supported by a reasonable level of accruals.

APH-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. However, this level of accruals is also around the peer median and suggests the company is recording a proper level of reserves compared to its peers.

Trend Charts