International story

The company was very positive when it came to its international growth potential. The company reported its Dunkin’ Donuts international distribution points grew by 105 points to a total of 3,173 locations. Dunkin’ Donuts international increased its revenues 2.9% from the prior year. In the future the company will look to expand further into India, Vietnam, Russia, China, and Brazil to fuel its international growth rates. In 2013, the goal is to open 400 to 500 new locations between both brands. Over the next 10 years the company plans to open roughly 250 new Baskin-Robins locations while also expanding its Dunkin’ Donuts brand. In China and India, coffee demand is rising and the company should accelerate its growth plans to try and keep pace with Starbucks. Both these countries are becoming huge coffee markets and if Dunkin’ misses the boat I am afraid they will be presented with a much tougher landscape in the future.

Product innovation

On the conference call the company was very pleased with the progress made in expanding its current menu offerings. The company has been shifting its menu to allow regular customers to upgrade from just a donut to Breakfast Burritos, Red Velvet Donuts, and an array of sandwiches. The pipeline for future menu options is as long as it has ever been and new products are being welcomed with open arms. The expansion of the product line has shown to be key for increasing comparable same store sales as 75% of the growth came from higher tickets. In addition, these new products carry high margins which will greatly increases profitability for the franchisees as consumers add on to their coffee orders. By expanding the menu, the company can better differentiate itself from the many coffee alternatives on the market.

Falling commodity costs

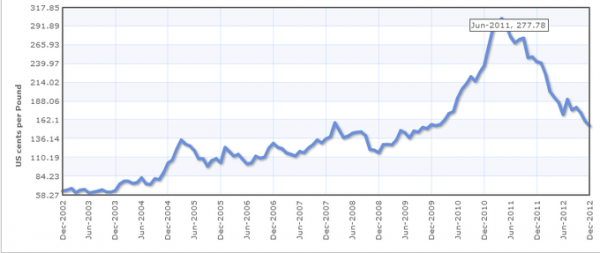

Currently, coffee prices have fallen to their lowest level since the middle of 2010 and have decreased significantly since the multi-year highs set in 2011. Dunkin’ and many competitors use Arabica beans for their coffee products. Below is a chart of the price of Arabica beans over the last 10 years:

Source: IndexMundi

The company expects its franchisees will experience lower commodity costs in 2013 as a result of the very low coffee prices. The lower coffee prices will help franchisees adjust to the rising costs for wheat caused by the drought. The longer the price of inputs stays low, the longer the franchisees will be able to generate especially high profit margins, which will benefit the entire company.

Conclusion

The company is well positioned to grow its brands domestically and internationally. I believe the company should work on speeding up the expansion into China and India as a failure to set strong footing in these regions would be very detrimental in the long run. I am very pleased to see ticket sales being driven higher by the popular new additions to the menu. As patrons increasingly trade up to the new products profit margins will rise for franchisees. As coffee prices continue to decline, the franchisees will continue to see their cost of goods sold decrease. I remain very bullish on the entire coffee space as global coffee demand continues to rise. Also, let’s not forget the company is now paying investors an attractive 2% dividend yield.

The article Dunkin’ Brands Group (NASDAQ:DNKN) Earnings Analysis originally appeared on Fool.com and is written by Nathaniel Matherson.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.