Amazon.com, Inc. (NASDAQ:AMZN) finished 2012 up about 40% for the year. In doing so, the stock outpaced its revenue growth rate; the most recent 10-Q showed net revenue up 27% in the third quarter of 2012 compared to the same period in the previous year, about even with sales growth in the first half of the year. In addition, with costs rising, Amazon- which has a market capitalization of over $110 billion- reported an operating loss, and that was after only about $300 million in operating income in H1. As a result Amazon lost 30 cents per share in the first nine months of 2012. While the company should deliver profits in Q4, current analyst expectations are that it will actually be unprofitable for the year.

Expectations for 2013 come to a consensus of $1.74 in earnings per share, which implies a forward P/E of 144. Even the highest forecast from the 35 analysts used in that consensus yields a forward earnings multiple close to 70. It’s clear that any justification of Amazon’s current stock price, let alone any expectations that the stock will rise in the next year, is based on the company’s losses being temporary and on earnings growing very rapidly even past 2013. The consensus earnings growth rate for the next five years is 33%. If we compound that over five years, and apply the resulting growth to the consensus forecast for 2013, we get 2018 earnings per share of $7.24. That would still represent an earnings multiple of more than 30, after five years of the stock trading at its current levels. We think that the price is far too high to recommend buying, and Amazon.com, Inc. actually looks like a good short candidate.

Billionaire Ken Fisher’s Fisher Asset Management owned 2.5 million shares of Amazon.com, Inc. at the end of September, making it one of the ten largest single stock positions in the fund’s 13F portfolio (find more of Fisher’s favorite stocks). A pair of Tiger Cubs each had more than $200 million of their fund’s money invested in the stock as well: John Griffin’s Blue Ridge Capital reported owning 1.5 million shares while Philippe Laffont’s Coatue Management had about 790,000 shares in its own portfolio. See more stock picks from John Griffin and from Philippe Laffont. Other interest in the company made Amazon one of the ten most popular services stocks among hedge funds.

There are two classes of stocks we can compare to Amazon; the first of these is technology companies Google Inc (NASDAQ:GOOG) and Apple Inc. (NASDAQ:AAPL), which compete with Amazon in consumer electronics. The forward P/Es here are 15 and 9, respectively. Google’s earnings have taken a hit with its addition of the troubled Motorola Mobility Holdings, but even its trailing multiple is 22 and of course its implied improvement is much weaker than Amazon’s. Apple actually trades at 12 times trailing earnings, so it should increase in price if the company is able to deliver any growth at all. It looks like a good value, and certainly a better buy than Amazon.

Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT) are competitors with Amazon’s discount retail business. Target trades at a small discount to its larger peer, at 12 times forward earnings estimates as opposed to Wal-Mart’s forward P/E of 13; in both cases the Street expects modest increases in earnings in 2013. In their most recent fiscal quarter, each company reported moderate growth in net income compared to the same period in the previous fiscal year- Wal-Mart’s was the lower of the two, at 9%- and the stocks are cheap enough that the businesses don’t need to improve much going forward for the current price to make sense. They are certainly safer stocks than Amazon is.

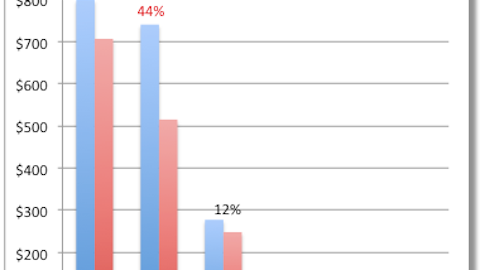

In fact, for $1 worth of Amazon’s 2013 consensus earnings per share (essentially, $144, the forward P/E multiple), investors can buy nearly $3 in forward earnings per share from each of Apple ($28, 3 times the forward P/E), Google ($46), Wal-Mart ($38), and Target ($36). We don’t think that Amazon’s growth prospects justify that wide a spread in valuation, and expect it to underperform these peers.