Health is priceless; health care isn’t.

As a medical-devices company, St. Jude Medical, Inc. (NYSE:STJ) benefits from many of the unique elements of the industry that make it attractive for dividend investors. We all know it’s impossible to put a price on one’s health and well-being. Because of that, the health-care sector at large is much less sensitive to downturns in consumer spending. This dynamic, along with the aging and increasingly unhealthy society that we’re all well aware of, is a key reason health-care spending will continue to grow.

But while these big-picture trends might be driving the overall industry, investors looking at specific health-care dividend stocks need to dig a layer deeper to understand the company-specific issues at work. After all, dividends aren’t a guarantee, and if the going gets tough enough, even a “stable” health-care stock could cut — or eliminate — its dividend. With that being said, let’s check on where St. Jude Medical, Inc. (NYSE:STJ)’s dividend has been, and try to determine where it’s going.

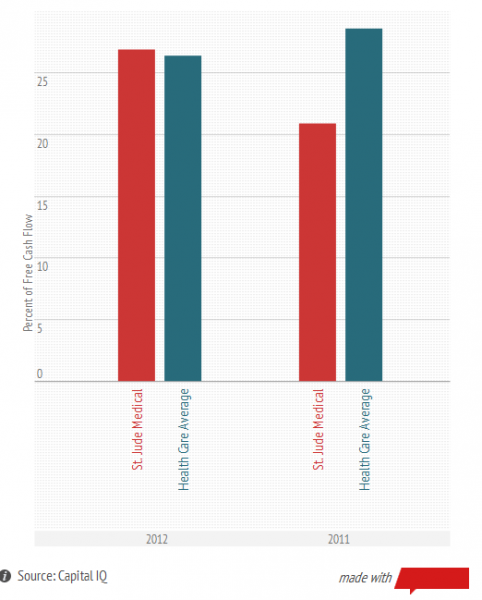

Payout ratios

A quick-and-dirty technique for checking a dividend’s sustainability is looking at something called the payout ratio. Typically, this is expressed as a percentage, looking at a company’s dividend per share relative to its net income per share. That’s a decent start, but I prefer to use a slightly different measurement that replaces net income, an accounting measurement, with something more tangible — cold, hard cash. Let’s see how much of St. Jude Medical, Inc. (NYSE:STJ)’s free cash flow has been eaten up by its dividend payments over the past two years. The lower, the better, suggesting more capacity for future dividend increases.

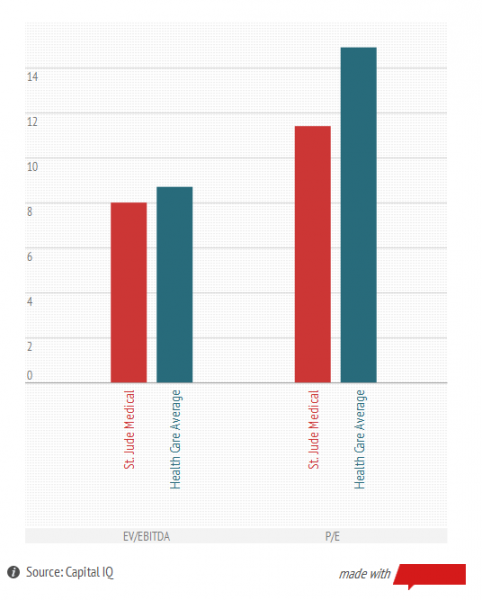

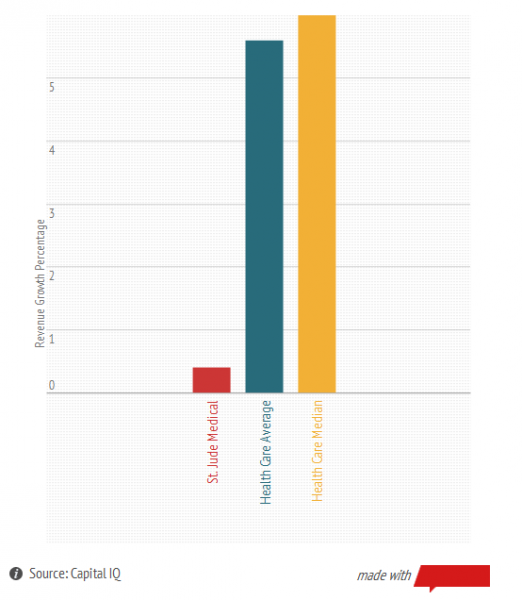

Up to this point, we’ve looked at St. Jude Medical’s dividend in the past, and we’ve also seen how the market perceives its stock today. However, the most important factor to consider when understanding a dividend’s future is where the company’s cash flow is heading. It’s hard to generate more cash without growing sales, so let’s look at what industry analysts are expecting for St. Jude Medical, Inc. (NYSE:STJ)’s revenue growth relative to peers this year.

St. Jude Medical has been dealing with a sluggish cardiac rhythm management devices market, which has seen implant volume decline across the United States. Struggles at home, combined with lower volumes driven by Europes economic struggles, have largely offset growth in Asia and other parts of the world. But while the top-line picture seems a bit uncertain in the near term, St. Jude is considered a leader in a medical-devices market benefiting from some long-term demographic shifts.

Like many of its peers, St. Jude Medical, Inc. (NYSE:STJ) spends a greater amount of free cash flow on share repurchases. In fact, last year dividends and share repurchases accounted for more than 100% of free cash flow. Not the most sustainable situation for a company dealing with revenue headwinds. However, management did just boost the dividend another 9% last month and has the flexibility to shift those capital allocation decisions toward dividends as it sees fit. St. Jude isn’t my favorite dividend stock in health care, but this is a payout you can rely on.

The article Does St. Jude Medical Have a Rock-Solid Dividend? originally appeared on Fool.com and is written by Brenton Flynn.

Brenton Flynn and The Motley Fool have no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.