Riverwater Partners, an investment management company, released its “Small Cap Strategy” Q4 2025 investor letter. A copy of the letter can be downloaded here. The Strategy underperformed the Russell 2000 Index during the fourth quarter as well as in FY2025. The stock selection drove the underperformance of the Strategy in the quarter. The strategy’s emphasis on high-quality stocks lagged behind broader market trends. However, the firm expects the environment to be more favorable for high-quality businesses in 2026. In addition, please check the Strategy’s top five holdings to know its best picks in 2025.

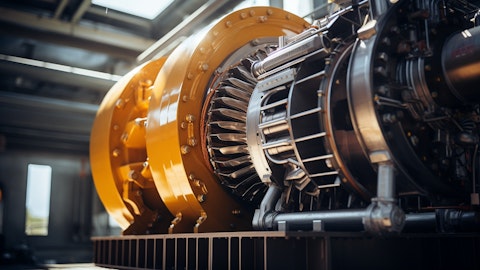

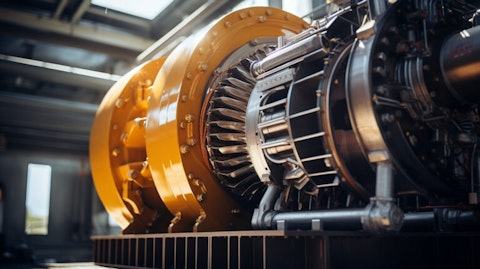

In its fourth-quarter 2025 investor letter, Riverwater Partners Small Cap Strategy highlighted stocks like Kodiak Gas Services, Inc. (NYSE:KGS), noting it as a new purchase during the quarter. Kodiak Gas Services, Inc. (NYSE:KGS) is a US-based contract compression infrastructure company for customers in the oil and gas industry. Kodiak Gas Services, Inc. (NYSE:KGS) shares traded between $29.25 and $50.43 over the past 52 weeks. On January 22, 2026, Kodiak Gas Services, Inc. (NYSE:KGS) stock closed at $39.91 per share. One-month return of Kodiak Gas Services, Inc. (NYSE:KGS) was 9.79%, and its shares gained 11.45% of their value over the last three months. Kodiak Gas Services, Inc. (NYSE:KGS) has a market capitalization of $3.42 billion.

Riverwater Partners Small Cap Strategy stated the following regarding Kodiak Gas Services, Inc. (NYSE:KGS) in its fourth quarter 2025 investor letter:

“Kodiak Gas Services, Inc. (NYSE:KGS): We added Kodiak Gas Services, Inc., a leading provider of contract compression services to the exploration and production and midstream energy markets. Founded approximately 15 years ago and remaining founder-led, KGS operates in a consolidated industry with a limited number of scaled competitors and has distinguished itself through innovation, best-in-class training programs, and disciplined capital allocation.

The long-term demand outlook appears favorable, with continued growth in oil and gas production volumes—particularly natural gas—driven by LNG export expansion, rising power demand from data centers, and broader electrification trends. While commodity prices are inherently volatile, we believe volume growth is the more relevant driver for compression demand, which directly benefits KGS. Supported by long-term, take-or-pay style contracts, the company is well positioned to generate durable free cash flow, return capital through dividends and share repurchases, and compound earnings at an attractive and consistent rate over time.”

Kodiak Gas Services, Inc. (NYSE:KGS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 32 hedge fund portfolios held Kodiak Gas Services, Inc. (NYSE:KGS) at the end of the third quarter, compared to 38 in the previous quarter.While we acknowledge the risk and potential of Kodiak Gas Services, Inc. (NYSE:KGS) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Kodiak Gas Services, Inc. (NYSE:KGS) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Kodiak Gas Services, Inc. (NYSE:KGS) and shared the list of best young stocks to buy and hold for 3 years. In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.