The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 30th. We at Insider Monkey have made an extensive database of more than 873 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Genco Shipping & Trading Limited (NYSE:GNK) based on those filings.

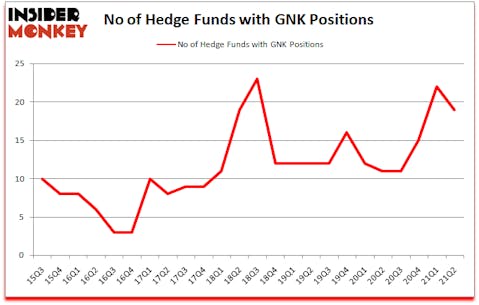

Is Genco Shipping & Trading Limited (NYSE:GNK) the right investment to pursue these days? The best stock pickers were becoming less confident. The number of bullish hedge fund bets were trimmed by 3 lately. Genco Shipping & Trading Limited (NYSE:GNK) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 23. Our calculations also showed that GNK isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Charles Davidson of Wexford Capital

Now we’re going to review the key hedge fund action regarding Genco Shipping & Trading Limited (NYSE:GNK).

Do Hedge Funds Think GNK Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the first quarter of 2020. By comparison, 11 hedge funds held shares or bullish call options in GNK a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Genco Shipping & Trading Limited (NYSE:GNK) was held by Centerbridge Partners, which reported holding $112 million worth of stock at the end of June. It was followed by Two Sigma Advisors with a $14.5 million position. Other investors bullish on the company included Millennium Management, Arrowstreet Capital, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Centerbridge Partners allocated the biggest weight to Genco Shipping & Trading Limited (NYSE:GNK), around 10.24% of its 13F portfolio. Manatuck Hill Partners is also relatively very bullish on the stock, earmarking 1.18 percent of its 13F equity portfolio to GNK.

Judging by the fact that Genco Shipping & Trading Limited (NYSE:GNK) has faced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies that elected to cut their entire stakes heading into Q3. Intriguingly, Michael Burry’s Scion Asset Management dropped the largest stake of the 750 funds followed by Insider Monkey, totaling about $3.6 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund cut about $1.4 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 3 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Genco Shipping & Trading Limited (NYSE:GNK) but similarly valued. These stocks are SLR Investment Corp. (NASDAQ:SLRC), Seritage Growth Properties (NYSE:SRG), The First Bancshares, Inc. (NASDAQ:FBMS), U.S. Lime & Minerals Inc. (NASDAQ:USLM), Newtek Business Services Corp (NASDAQ:NEWT), FLEX LNG Ltd. (NYSE:FLNG), and Cincinnati Bell Inc. (NYSE:CBB). This group of stocks’ market values resemble GNK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLRC | 11 | 30537 | 2 |

| SRG | 10 | 122880 | 0 |

| FBMS | 9 | 56841 | 1 |

| USLM | 5 | 49402 | 1 |

| NEWT | 4 | 7207 | -1 |

| FLNG | 6 | 7467 | 5 |

| CBB | 14 | 154767 | 2 |

| Average | 8.4 | 61300 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.4 hedge funds with bullish positions and the average amount invested in these stocks was $61 million. That figure was $175 million in GNK’s case. Cincinnati Bell Inc. (NYSE:CBB) is the most popular stock in this table. On the other hand Newtek Business Services Corp (NASDAQ:NEWT) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Genco Shipping & Trading Limited (NYSE:GNK) is more popular among hedge funds. Our overall hedge fund sentiment score for GNK is 76.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Unfortunately GNK wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on GNK were disappointed as the stock returned -6.6% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Genco Shipping & Trading Ltd (NYSE:GNK)

Follow Genco Shipping & Trading Ltd (NYSE:GNK)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top Construction Companies in the US in 2021

- 10 Best Pharmaceutical Stocks to Buy According to Billionaire Joseph Edelman

- 15 Best Technology Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.