Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

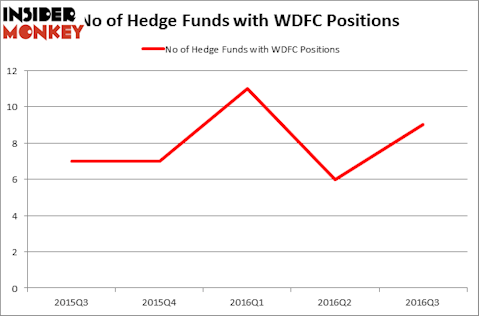

Is WD-40 Company (NASDAQ:WDFC) a superb investment right now? Hedge funds are indeed betting on the stock. The number of long hedge fund bets that are revealed through the 13F filings inched up by 3 recently. There were 6 hedge funds in our database with WDFC holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Pra Group, Inc. (NASDAQ:PRAA), Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV), and Amedisys Inc (NASDAQ:AMED) to gather more data points.

Follow Wd 40 Co (NASDAQ:WDFC)

Follow Wd 40 Co (NASDAQ:WDFC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

ValeStock / Shutterstock.com

Keeping this in mind, let’s review the fresh action encompassing WD-40 Company (NASDAQ:WDFC).

How have hedgies been trading WD-40 Company (NASDAQ:WDFC)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 50% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in WDFC heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the largest position in WD-40 Company (NASDAQ:WDFC). Renaissance Technologies has a $64.9 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Mario Gabelli of GAMCO Investors, with a $4.9 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions consist of Cliff Asness’ AQR Capital Management, Chuck Royce’s Royce & Associates and Alec Litowitz and Ross Laser’s Magnetar Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, some big names have been driving this bullishness. Magnetar Capital, led by Alec Litowitz and Ross Laser, initiated the largest position in WD-40 Company (NASDAQ:WDFC). Magnetar Capital had $0.3 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.2 million position during the quarter. The other funds with brand new WDFC positions are Matthew Tewksbury’s Stevens Capital Management, Mike Vranos’ Ellington, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks similar to WD-40 Company (NASDAQ:WDFC). We will take a look at Portfolio Recovery Associates, Inc. (NASDAQ:PRAA), Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV), Amedisys Inc (NASDAQ:AMED), and FBL Financial Group (NYSE:FFG). All of these stocks’ market caps resemble WDFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRAA | 8 | 114828 | 1 |

| EVV | 3 | 4448 | -1 |

| AMED | 14 | 81873 | -4 |

| FFG | 6 | 5826 | 1 |

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $74 million in WDFC’s case. Amedisys Inc (NASDAQ:AMED) is the most popular stock in this table. On the other hand Eaton Vance Ltd Duration Income Fund (NYSEMKT:EVV) is the least popular one with only 3 bullish hedge fund positions. WD-40 Company (NASDAQ:WDFC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AMED might be a better candidate to consider taking a long position in.

Disclosure: None