Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Superior Industries International Inc. (NYSE:SUP) from the perspective of those elite funds.

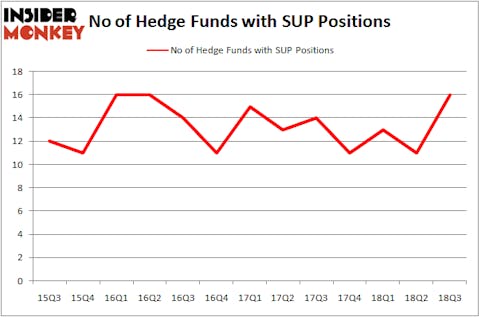

Superior Industries International Inc. (NYSE:SUP) shareholders have witnessed an increase in enthusiasm from smart money lately. SUP was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 11 hedge funds in our database with SUP holdings at the end of the previous quarter. Our calculations also showed that SUP isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action regarding Superior Industries International Inc. (NYSE:SUP).

Hedge fund activity in Superior Industries International Inc. (NYSE:SUP)

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 45% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SUP over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Superior Industries International Inc. (NYSE:SUP) was held by GAMCO Investors, which reported holding $14.4 million worth of stock at the end of September. It was followed by DC Capital Partners with a $10.2 million position. Other investors bullish on the company included Harvey Partners, D E Shaw, and Millennium Management.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, established the biggest call position in Superior Industries International Inc. (NYSE:SUP). Millennium Management had $2.6 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also made a $0.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Jeffrey Talpins’s Element Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Superior Industries International Inc. (NYSE:SUP). We will take a look at Tekla World Healthcare Fund (NYSE:THW), BioSpecifics Technologies Corp. (NASDAQ:BSTC), Cedar Realty Trust Inc (NYSE:CDR), and resTORbio, Inc. (NASDAQ:TORC). This group of stocks’ market values match SUP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THW | 1 | 634 | -1 |

| BSTC | 10 | 45243 | 2 |

| CDR | 12 | 24385 | 0 |

| TORC | 4 | 89978 | 1 |

| Average | 6.75 | 40060 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $41 million in SUP’s case. Cedar Realty Trust Inc (NYSE:CDR) is the most popular stock in this table. On the other hand Tekla World Healthcare Fund (NYSE:THW) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Superior Industries International Inc. (NYSE:SUP) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.